Today, i got the email the "me" sent to me on December 31, 2005. The content is as below:

"Dear FutureMe, what are you doing now? I really want to know if you have got a fantastic career and a warm family. I am now preparing to set up the IBM system. Remember, the X41 system. This is the last day of 2005. I may fly to Milan next year. Do you know it would be good or bad? I still wanna to go further. At the same time, I miss the family.

P.S. do you know what you would do in 2007."

In fact, this website www.futureme.org really moved me. The email "me" last year made me remind a lot of thing I went through in the past time. Thanks to futureme.org to give me such an enjoyable feeling. So I donated US$1 to the website via my paypal account. (Accidentally, I have several bucks in the account because of a year's work for a VOIP weblog last year).

The website said it need donation to make everything free. Unfortunately, only 17 people including me have donated it. Wish there will be more. Internet is not always a free lunch.

Isn't Internet amazing?!!! you could listen to the "old you" and write to the "future you", too.

So this year, I will write another piece to the "future me" next year. I know, she will enjoy this.

Sunday, December 31, 2006

Thursday, December 28, 2006

Internet to the outside world down

such a terrible turn down on the cable which was damaged by yesterday's Taiwan earthquake. I couldn't access to my Gmail. Also couldn't access to MSN from the office(but could from home). But why blogger still works if gmal doesn't? and why everything was fine yesterday evening just after the earthquake happened but nothing worked today?

So strange.

So strange.

Wednesday, December 27, 2006

Earthquake touches Hong Kong

I experienced my first earthquake in Hong Kong during 8:40 to 8:50 pm on December 26. It was really scaring when I was sitting in the office working on my features. The floor had been swinging for five or six times before someone in the office started screaming. Then a silent period for five minutes. Another round came but only for one swing this time. But in fact, I was already prepared to run out of the building with some water.

Checked quickly on the TV news which said Taiwan just had an earthquake, details are here(reuters). Seems Hong Kong and Southern China both felt it. TV news said that the Kowloon Bay area is the most serious attacked place. Seems nobody got hurt, which is lucky.

I never met earthquake in Hong Kong. Isn't that people saying the city is a lucky place without any earthquakes? Anyway, no place is safe.....

Checked quickly on the TV news which said Taiwan just had an earthquake, details are here(reuters). Seems Hong Kong and Southern China both felt it. TV news said that the Kowloon Bay area is the most serious attacked place. Seems nobody got hurt, which is lucky.

I never met earthquake in Hong Kong. Isn't that people saying the city is a lucky place without any earthquakes? Anyway, no place is safe.....

Tuesday, December 26, 2006

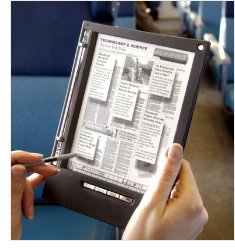

print turns to electronic, reluctant or hard?

My long-time online friend Fons seems didn't care on what's going on in the Hong Kong's largest newspaper. To him, "By maintaining a solid financial firewall, its articles fail to become part of the ongoing online discussions, making into the laughing stock of the 21st century." I could understand his feeling. As one of the active foreign bloggers in China, Fons has more than enough reason to believe the Internet power, and in turn, he thinks many things should be exposed out of the financial wall to Internet users.

When I was a young journalism student and active Internet surfer too, I couldn't agree more on his opinion. But after working in newspapers for several years, I understood more on the worries of newpaper, especiall the leading newspaper, from an inside view. SCMP is not the only one having the wall, Financial Times and Wall Street Journal, two most accomplished business newspaper, also have the financial wall. As a new start-up media company, it is much easier to share the content freely in order to attract new readiers, and thus new advertisements; but for established and branded newspaper, their worries on turning around to use the new online profitable model, may kill their already-successful business model in one day. Destination to the electronic age already exists in everyone's mind, but "when" and "how" are the biggest problems. Several issues to consider:

(1) Subscribers.

When you could read the newspaper online freely, will you still buy newspapers? I believe that's the most important question in the desk of every newspaper executives. Possibly, many people will stop buying newspaper, so in the turning-around process, how to make sure the smooth connection between the time point when the subscribers could still buy the prints and the time point when the advertising could cover the loss of subscribing revenues.

(2) Content.

How many content could be publicized freely is also another question. It decides finally on how many print readers will leave and how many advertisement could attract. FT.com will make the first and second paragraph of every story as free, which is a common model among many media; getting advertisers' eyes as well as readers' stomach is a good trick.

(3) Employee.

Online expansion also needs more stuffs to work on more as getting rid of the space limitation on the print copies. It is hard to recruit good employees when online revenue is still zero(except for the period of Internet bubble). So if is it a good way to push the current employees to contribute more to the online copy or invest more in the expansion remains a question.

Having said those, one of my good suggestions for estabilished newspaper is trying to set up "free" model in the emerging market providing new content to new customers. The online Chinese version of Financial Times and Wall Street Journal have done a good job in bringing many Chinese readers without affecting the current revenue from English version. They also brought a bunch of advertisers. At the current stage, the newspaper could subsidize "the new model of new content" based on the revenue from "old model of old content". When the new model is profitable enough, the old model could be subsidized in a reverse way to finish its turn around.

That's just like the egg-basket strategy. When you could afford the risk of losing all eggs, you could definitely put all eggs in one basket; but if you couldn't, then better put some eggs in another basket to test its stability, and then try to move more. Finally some day you will put all eggs in one basket when you trust that basket fully.

P.S. SCMP also started to provide its Chinese content freely on the website. A good beginning but still in the progress.

When I was a young journalism student and active Internet surfer too, I couldn't agree more on his opinion. But after working in newspapers for several years, I understood more on the worries of newpaper, especiall the leading newspaper, from an inside view. SCMP is not the only one having the wall, Financial Times and Wall Street Journal, two most accomplished business newspaper, also have the financial wall. As a new start-up media company, it is much easier to share the content freely in order to attract new readiers, and thus new advertisements; but for established and branded newspaper, their worries on turning around to use the new online profitable model, may kill their already-successful business model in one day. Destination to the electronic age already exists in everyone's mind, but "when" and "how" are the biggest problems. Several issues to consider:

(1) Subscribers.

When you could read the newspaper online freely, will you still buy newspapers? I believe that's the most important question in the desk of every newspaper executives. Possibly, many people will stop buying newspaper, so in the turning-around process, how to make sure the smooth connection between the time point when the subscribers could still buy the prints and the time point when the advertising could cover the loss of subscribing revenues.

(2) Content.

How many content could be publicized freely is also another question. It decides finally on how many print readers will leave and how many advertisement could attract. FT.com will make the first and second paragraph of every story as free, which is a common model among many media; getting advertisers' eyes as well as readers' stomach is a good trick.

(3) Employee.

Online expansion also needs more stuffs to work on more as getting rid of the space limitation on the print copies. It is hard to recruit good employees when online revenue is still zero(except for the period of Internet bubble). So if is it a good way to push the current employees to contribute more to the online copy or invest more in the expansion remains a question.

Having said those, one of my good suggestions for estabilished newspaper is trying to set up "free" model in the emerging market providing new content to new customers. The online Chinese version of Financial Times and Wall Street Journal have done a good job in bringing many Chinese readers without affecting the current revenue from English version. They also brought a bunch of advertisers. At the current stage, the newspaper could subsidize "the new model of new content" based on the revenue from "old model of old content". When the new model is profitable enough, the old model could be subsidized in a reverse way to finish its turn around.

That's just like the egg-basket strategy. When you could afford the risk of losing all eggs, you could definitely put all eggs in one basket; but if you couldn't, then better put some eggs in another basket to test its stability, and then try to move more. Finally some day you will put all eggs in one basket when you trust that basket fully.

P.S. SCMP also started to provide its Chinese content freely on the website. A good beginning but still in the progress.

Monday, December 25, 2006

something interesting to read

Keso is one of the few bloggers in China having deep knowledge on the IT industry. In this post, he publicized a letter from an employee with Ebay Eachnet on the inside first hand info behind the deal between Ebay and Tom Online. The letter is in English, and quite interesting, though couldn't be confirmed it is true or not.

Wednesday, December 20, 2006

Could U.S. International model work in China?

Heard from someone on a very interesting observation: "There are two theory in China's internet world: (1) If U.S. could do it in this way, we could also do it", (2) Nothing in U.S. could be implemented in China.

In fact, I would like to see U.S. International model will work in China but only under the management of local professionals. Say, when Ebay finally reached the deal with Tom.com on selling(sorry, they called it the cooperation) of Eachnet.com, many big financial media called it is a failure for American Internet model to work in China. However, it seems no one could remember how Eachnet.com, a once popular star auction website based in Shanghai, wrote a new page in China's internet history when the two HBS-graduate founders successfully implanted Ebay's model into China. The failure today is not caused by a couldn't-work model, but by the local management Ebay hired to run Eachnet.

So I would only sigh to Eachnet which couldn't deserve some excellent local management. But in another word, it is more like U.S. corporate culture to control everything in its acquired companies. Different from European peers, American companies consider the controlling right as the most important item when they make international acquisition. For example, Citigroup, who just bought Guangdong Development Bank, already assigned a new CEO to the Chinese venture. Succeed or not, we will see, though I hold a negative view.

In the different business environment, businessmen should try to trust the local professionals as they are the only people knowing the market. That's the most important key in developing business in other countries and other cultures.

Good luck to Eachnet, and thousands of companies which may follow its fate.

In fact, I would like to see U.S. International model will work in China but only under the management of local professionals. Say, when Ebay finally reached the deal with Tom.com on selling(sorry, they called it the cooperation) of Eachnet.com, many big financial media called it is a failure for American Internet model to work in China. However, it seems no one could remember how Eachnet.com, a once popular star auction website based in Shanghai, wrote a new page in China's internet history when the two HBS-graduate founders successfully implanted Ebay's model into China. The failure today is not caused by a couldn't-work model, but by the local management Ebay hired to run Eachnet.

So I would only sigh to Eachnet which couldn't deserve some excellent local management. But in another word, it is more like U.S. corporate culture to control everything in its acquired companies. Different from European peers, American companies consider the controlling right as the most important item when they make international acquisition. For example, Citigroup, who just bought Guangdong Development Bank, already assigned a new CEO to the Chinese venture. Succeed or not, we will see, though I hold a negative view.

In the different business environment, businessmen should try to trust the local professionals as they are the only people knowing the market. That's the most important key in developing business in other countries and other cultures.

Good luck to Eachnet, and thousands of companies which may follow its fate.

Saturday, December 16, 2006

Such a long week

Sorry for having not uploaded posts these days. It's such a long week to me since Monday when some sudden news came. I am always quick to adapt the latest news, but this time it took me a week to think through the whole thing.

I am not in a position to do a story on the whole thing(as I couldn't be fair enough) , but when this website reported on it in a unfair way in terms of biased view, I think I should say something to balance the article. Many outsiders, especially people doing business in the mainland China, have seen our changes in the business coverage during the past seven months. We have more breaking news, more in-depth features, and more efforts in trying to cover a true mainland China. The direction is different, but absolutely correct, while most of the readers I've talked to praised it as a good move. Behind all the politics, we should see the effort made by someone to pursue a long term development. It is hard for a regional newspaper, once only focusing in Hong Kong for 100 years, to make such move. But it has to for its own sake. When economists are talking about the peg between Hong Kong dollars and RMB, when stock market sees many mainland-concept IPOs, Hong Kong media has to extend its hands and legs to meet the demand of all readers.

Having said, politics, sometimes, makes the situation more complicated, and makes people including me angry.

Will Hong Kong be marginalized when other mainland China cities are developing fast? Even the taxi drivers in Hong Kong will tell you there is possibility, say, in ten years. What HK should do then? be more open and be more involved in the China's economy. The city does have an advantage based on the efforts from the older hard-working generations, and now, with the changing surroundings, Hong Kong people is also quick to adapt to new things, so will Hong Kong media do, I believe.

"Adaptability and flexibility are the most important two things in a new situation", a foreign expat working in BJ and having a successful career once told me. Now, I sent the words as Christmas gift to all Hong Kong media. And Merry Christmas.

I am not in a position to do a story on the whole thing(as I couldn't be fair enough) , but when this website reported on it in a unfair way in terms of biased view, I think I should say something to balance the article. Many outsiders, especially people doing business in the mainland China, have seen our changes in the business coverage during the past seven months. We have more breaking news, more in-depth features, and more efforts in trying to cover a true mainland China. The direction is different, but absolutely correct, while most of the readers I've talked to praised it as a good move. Behind all the politics, we should see the effort made by someone to pursue a long term development. It is hard for a regional newspaper, once only focusing in Hong Kong for 100 years, to make such move. But it has to for its own sake. When economists are talking about the peg between Hong Kong dollars and RMB, when stock market sees many mainland-concept IPOs, Hong Kong media has to extend its hands and legs to meet the demand of all readers.

Having said, politics, sometimes, makes the situation more complicated, and makes people including me angry.

Will Hong Kong be marginalized when other mainland China cities are developing fast? Even the taxi drivers in Hong Kong will tell you there is possibility, say, in ten years. What HK should do then? be more open and be more involved in the China's economy. The city does have an advantage based on the efforts from the older hard-working generations, and now, with the changing surroundings, Hong Kong people is also quick to adapt to new things, so will Hong Kong media do, I believe.

"Adaptability and flexibility are the most important two things in a new situation", a foreign expat working in BJ and having a successful career once told me. Now, I sent the words as Christmas gift to all Hong Kong media. And Merry Christmas.

Wednesday, December 06, 2006

3G, the second round for service providers to grow

Hong Kong has its honor to hold the ITU Telecom World 2006 from December 4 to December 8, the first ever city outside of Switzerland to hold such an event.

The event is so big to even affect the telecom stock in Hong Kong. When China Telecom president Leng Rongquan said China will launch the 3G service soon, the company's stock increased by 15 percent that day. Market is always driven by breaking news, while however, not many people think it in a long-term way.

From my telecom experience, the creative business model usually doesn't come from the telecom operator side. Say, the model of SP, or service providers, only followed after thousands of small private companies which support the China Mobile and China Unicom. Telecom operators, whose main character is monopoly, are hard in trying new and effective model because of its own big strucuture. So the smart way is to give a piece of pie to private companies, and thus, benefit themselves.

So to me, 3G is more like the opportunity for second round of growth for service providers. In the first round, companies such as Sina.com, Sohu.com and Netease.com benefited most, while in the second round, the most creative one may be from some new one.

Among them, media conglomarates such as CCTV and Shanghai Media Group are likely to benefit. The two already competed hardly on the launching of IPTV, a way for people to watch TV via handy or order programmes freely. With 3G, they will have a better platform which are faster.

However, to them, the problem is still their character. As state-owned companies for a long time, it is a question if they could response quickly as small private ones and if they have any advantages beyond their monopoly character.

Saying so, monopoly usually win at last, though not the full pie, 80 percent is pretty enough.

The event is so big to even affect the telecom stock in Hong Kong. When China Telecom president Leng Rongquan said China will launch the 3G service soon, the company's stock increased by 15 percent that day. Market is always driven by breaking news, while however, not many people think it in a long-term way.

From my telecom experience, the creative business model usually doesn't come from the telecom operator side. Say, the model of SP, or service providers, only followed after thousands of small private companies which support the China Mobile and China Unicom. Telecom operators, whose main character is monopoly, are hard in trying new and effective model because of its own big strucuture. So the smart way is to give a piece of pie to private companies, and thus, benefit themselves.

So to me, 3G is more like the opportunity for second round of growth for service providers. In the first round, companies such as Sina.com, Sohu.com and Netease.com benefited most, while in the second round, the most creative one may be from some new one.

Among them, media conglomarates such as CCTV and Shanghai Media Group are likely to benefit. The two already competed hardly on the launching of IPTV, a way for people to watch TV via handy or order programmes freely. With 3G, they will have a better platform which are faster.

However, to them, the problem is still their character. As state-owned companies for a long time, it is a question if they could response quickly as small private ones and if they have any advantages beyond their monopoly character.

Saying so, monopoly usually win at last, though not the full pie, 80 percent is pretty enough.

Saturday, December 02, 2006

coming back from BJ to HK

I am back to HK today. The weather is so nice, cool and dry. Feel much more comfortable in my apartment than the hotel.

Need to find out what's happening in Hong Kong....

Also, could access to my blog now and have a 100M internet. so happy now.

Need to find out what's happening in Hong Kong....

Also, could access to my blog now and have a 100M internet. so happy now.

Tuesday, November 21, 2006

Climbing fragrant hills in BJ

Fragrant Hills, or Xiang Shan, is the most popular place during Autumn in Beijing. Red leaves, clean air and cool weather, you couldn't find a reason not to go there.

The hill was once the place for the emperors to rest and have a breath out of their busy lives. They would definitely enjoy such a peaceful place.

I used almost an hour and half (including the rest and shopping time) to climb to the top from the bottom, which is really impressingly fast. The view is so fantastic beautiful, especially when you could shout strongly saying "I am on the top of the hill". In the minute, I feel like the happiest person in the world.

Tuesday, November 14, 2006

diversifying Focus Media's profitable terminals

Focus Media, a legend in China's media industry last industry, is famous for its idea to put terminals in the offices and residential building. The concept is simple: the middle-class people usually working or living in those buildings will look at those advertisements showing on the terminal flat screens when they are boringly waiting for the lift and taking the lift.

Here, I, as a common client but not as a professional financial journalist, think something may go wrong on this idea. The building I am living in BJ right now, (I am on a trip to BJ from HK if everyone remember), has two TV terminals on the first floor. It may be for people waiting for the life coming. Unfortunately, I have been living here for almost four weeks, but couldn't remember a single advertisement from those terminals.

First, because I never need to wait for a lift to come. The lift is always available, so I only need a maximum five seconds to get to the lift, while never put my eyes on the screen beside.

Second, and more importantly, is I am never interested in pure advertising content. In fact, I will call the sales way of focus media more like a forced advertising way, while people have to, not actively seek to, watch the advertisements. Imagine if you will watch a pure advertising TV channel. No, I will not, as I will be bored.

Focus Media is still making good money, as advertisers already believed in this story created by both company and the venture capitalists which once invested in this company. It also expands quickly with more terminals covering more buildings. But I would like to remind all of the people to check the effective number of clients the terminals attracted, instead of a null quick expanding number. One terminal doesn't certainly mean people paying attention to those advertisements.

When I was in SH, I found many taxies already had a small screen in their cars. I found the ones carried more interesting contents, say Music Videos from Channel V, are more attracted to me and I watched them closely even when advertisements come. it means audiences need interesting contents, instead of pure, or boring even worse, advertisements. So I doubt Focus Media's profitability in the future.

Just personal opinions, not on behalf of any others people or any media.

Monday, November 06, 2006

how to find a job in China's financial sector

I got an email from one of my readers. He(or She) asked me to advise the job hunting in China's financial market. I am trying my best to answer it here. Hope it will help that reader, as well as many others. But what I would like to say that it is more important for me to tell more details which sector in the financial field you guys want to work in.

- the job market, number of job opportunities available

The job market is pretty good this year. Many of banking getting listed are recruiting more people, especially from overseas. one example is ICBC is recruiting now, even including fresh graduates, which is not that usual. Securities firms and insurers are also have a good time, too.

The job market is pretty good this year. Many of banking getting listed are recruiting more people, especially from overseas. one example is ICBC is recruiting now, even including fresh graduates, which is not that usual. Securities firms and insurers are also have a good time, too.

- the skills generally required (language, technical, quantitative)

Languages are basically English and Mandarin. You must have some finance degree or better some working experiences from overseas, which will help a lot.

Languages are basically English and Mandarin. You must have some finance degree or better some working experiences from overseas, which will help a lot.

- Credentials, education (masters, CFA, MBA, the school name)

All of them will help, but depending on what types of firms you want to join. MBA will be the best to join the investment banks and consulting firms, while others will help you with other financial companies or industrial companies which need financial person.

All of them will help, but depending on what types of firms you want to join. MBA will be the best to join the investment banks and consulting firms, while others will help you with other financial companies or industrial companies which need financial person.

- what is the usual career path (starting positions, promotions, exit opportunities, the easiness of transitions into other industry)

Starting positions is depending how many experience you have. It is hard to tell in general. But I believe in a new sector, it will be easier to get promoted. As I know many investment bankers are pretty young, beyong their 40s.

Starting positions is depending how many experience you have. It is hard to tell in general. But I believe in a new sector, it will be easier to get promoted. As I know many investment bankers are pretty young, beyong their 40s.

- the pay scale (compared with other industries, benefits, tax)

Paid normall better than others, if not the best. Commercial banks paid pretty good among all types of careers before, and now investment bankers and consultant are catching up. But commercial banks usually have off-the-record income, such as house compensation, while the others may not have that.

Paid normall better than others, if not the best. Commercial banks paid pretty good among all types of careers before, and now investment bankers and consultant are catching up. But commercial banks usually have off-the-record income, such as house compensation, while the others may not have that.

- What are some of the bigger industries within Finance and what are the developing ones (Asset management, risk management, consulting, Investment Banking, Hedge funds, private equity, etc) ?

Bigger industries are commercial banks and brokerages. Hedge funds and private equities are growing, but still small. Fund managerment companies is also big, while expats could easily find a lot of sino-foreign joint ventures. Consulting, to tell the truth, is not as popular as before. Risk management is a pretty new area, but I believe it will develop quickly.

Bigger industries are commercial banks and brokerages. Hedge funds and private equities are growing, but still small. Fund managerment companies is also big, while expats could easily find a lot of sino-foreign joint ventures. Consulting, to tell the truth, is not as popular as before. Risk management is a pretty new area, but I believe it will develop quickly.

- Which cities are good for this industry (Shanghai, hongkong, guangzhou)?

hoho, this also depends on various sector, but to tell the truth, Guangzhou is not comparative with SH and HK. Hong Kong is still the international financial center, which is more efficient and regulated. Good place for investment bankers, at least based there to enjoy the low tax benefit. SH is better for sino-foreign joint venture career development, such as funds and importing/exporting related. BJ is a place for financial experts working closely with policies, such as commercial banks, investment banks, and even brokerages. Private equity and venture capital are usually based in BJ too. Also, SZ is also a good place for small and medium size companies, the city also has a lot of loca private equities and hedge funds.

All in all, it depends on various choices, and my understanding is just for reference. just meeting a banking expert last week, and he told me attitude is more important than others for financial professionals overseas to work in China. And that's true.

hoho, this also depends on various sector, but to tell the truth, Guangzhou is not comparative with SH and HK. Hong Kong is still the international financial center, which is more efficient and regulated. Good place for investment bankers, at least based there to enjoy the low tax benefit. SH is better for sino-foreign joint venture career development, such as funds and importing/exporting related. BJ is a place for financial experts working closely with policies, such as commercial banks, investment banks, and even brokerages. Private equity and venture capital are usually based in BJ too. Also, SZ is also a good place for small and medium size companies, the city also has a lot of loca private equities and hedge funds.

All in all, it depends on various choices, and my understanding is just for reference. just meeting a banking expert last week, and he told me attitude is more important than others for financial professionals overseas to work in China. And that's true.

Thursday, November 02, 2006

India and China

I was attending the Business CEO Forum in BJ on Wednesday. One of the session is on India and China's competitiveness. Why people always like to compare country from country? Especially like the emerging China, people first compared it to China, then India, then maybe some time U.S. But I would like to argue China is always China, with its unique history and opportunity and weakness. China has its own fantasy.

Among the Q&A session with a governor from Saudi Arabia, a guy from China Beijing Secondary Exchange, a government-owned secondary market for company sales, stood up and invited governor for a visit. It sounded no problem if he could stop then. But he continued to complain a lot on the foreign investors' bad opinion on China and....( I almost forgot his point in fact). The moderator had to stop him in a really rude way. I could say he is really brave but the timing was not proper, and the manner was not polite. One senstence, not a good show-off time.

Many Chinese businessmen are agressive these days, especially when dealing with foreign people, but in fact, they haven't learnt the well-rounded way to show themselves. I still remember when I meet the guy, a senior official with that exchange, in a conference where he gave an exciting speech. But during the conference break, I tried to talk to him, but he behaved in a really strange way: he raised his two hands near his mouth, without speaking anything, only his lips moving around, trying to show me he couldn't speak; doesn't make sense at all, right? if you don't want to talk to the media, then just tell them directly. why behave so strangely?

I always remember this, and I believe it shows they need a lot of professional training on how to do a good show off.

Among the Q&A session with a governor from Saudi Arabia, a guy from China Beijing Secondary Exchange, a government-owned secondary market for company sales, stood up and invited governor for a visit. It sounded no problem if he could stop then. But he continued to complain a lot on the foreign investors' bad opinion on China and....( I almost forgot his point in fact). The moderator had to stop him in a really rude way. I could say he is really brave but the timing was not proper, and the manner was not polite. One senstence, not a good show-off time.

Many Chinese businessmen are agressive these days, especially when dealing with foreign people, but in fact, they haven't learnt the well-rounded way to show themselves. I still remember when I meet the guy, a senior official with that exchange, in a conference where he gave an exciting speech. But during the conference break, I tried to talk to him, but he behaved in a really strange way: he raised his two hands near his mouth, without speaking anything, only his lips moving around, trying to show me he couldn't speak; doesn't make sense at all, right? if you don't want to talk to the media, then just tell them directly. why behave so strangely?

I always remember this, and I believe it shows they need a lot of professional training on how to do a good show off.

Saturday, October 28, 2006

Difference between ICBC's A share and H share

ICBC, finally, got listed, after a month's hard work of my colleagues and me. The first trading day, interesting things happened, A share in Shanghai increased by 5 percent, while H share in Hong Kong rose by 15 percent. (A share and H share were priced same) People asked why, and I asked too to SH fund managers. They have different answers, and I quoted them as well. But I got one simple answer for myself(not for newpaper, nor for anyone else) is like this:

Compare the average consumer price in SH and HK, SH is lower than HK of course. Then how come could the stock to have the same price between SH and HK?

So the trading different is natural to me. Then I got the question: so what will be the relations between stock market and consumer price? Will the stock market in HK with many mainland stocks same with SH lead the SH consumer price finally? or SH stock price will tend to be lower than HK for the same company?

Compare the average consumer price in SH and HK, SH is lower than HK of course. Then how come could the stock to have the same price between SH and HK?

So the trading different is natural to me. Then I got the question: so what will be the relations between stock market and consumer price? Will the stock market in HK with many mainland stocks same with SH lead the SH consumer price finally? or SH stock price will tend to be lower than HK for the same company?

terrible BJ transportation

Hong Kong could always be a financial center, just because of its efficiency: this is what I think most when my taxi met with traffic jam during the past days in BJ. For my working 12 hours in a day, almost a third was on the way, or on the way to get a taxi. So many transporation lights, so many traffic jam in every minute(even in the noon of Friday). I am kinda of used to it as I learnt that it will not become better even I become angry.

So HK, the city with no jam, will always be the place for the efficient work. In one second, you could reach everywhere without waiting in a taxi.

BJ is still good for politics, SH is catching up with BJ in terms of traffic jam(see how long it takes to go from Pudong to Puxi during the busy hour), while HK, smaller, is the most efficient. That's the advantage no one could catch up in five years, or maybe ten years.

So HK, the city with no jam, will always be the place for the efficient work. In one second, you could reach everywhere without waiting in a taxi.

BJ is still good for politics, SH is catching up with BJ in terms of traffic jam(see how long it takes to go from Pudong to Puxi during the busy hour), while HK, smaller, is the most efficient. That's the advantage no one could catch up in five years, or maybe ten years.

Tuesday, October 24, 2006

Wikipedia's ban got lifted

After I just complained on the wiki connection, I found the story from my professor Andrew Lih's blog on a comprehensive research of wiki's connection in every province in China. In fact, the ban on the wiki's english website was already lifted. Congratulations. China has another channel to communicate with the world la.

Speaking of wikipedia, it grows so fast. Every time I search something via google, link to wikipedia will always appear among the top five, which is quite impressive.

I always want to write some tips on how to make use of different search engine. With a computer background, I always use three search engines:

Google: good for direct search in english and Chinese for the specific websites. always good for search in english

Baidu: good for search the most popular info in Chinese. you will always know which article people read most. but bad for searching the right websites.

www.iask.com: created by Sina.com. it is kind of hidden behind the big name Sina, but I suggest sina.com seperate it as single searching business. This website is so good at searching on news archives, especially good for journalists and PRs. you could find all news for certain topic in the time sequence from the website which is backed up by the fantastic news database of Sina.com. really a waste when Sina.com doesn't promote it much.

Speaking of wikipedia, it grows so fast. Every time I search something via google, link to wikipedia will always appear among the top five, which is quite impressive.

I always want to write some tips on how to make use of different search engine. With a computer background, I always use three search engines:

Google: good for direct search in english and Chinese for the specific websites. always good for search in english

Baidu: good for search the most popular info in Chinese. you will always know which article people read most. but bad for searching the right websites.

www.iask.com: created by Sina.com. it is kind of hidden behind the big name Sina, but I suggest sina.com seperate it as single searching business. This website is so good at searching on news archives, especially good for journalists and PRs. you could find all news for certain topic in the time sequence from the website which is backed up by the fantastic news database of Sina.com. really a waste when Sina.com doesn't promote it much.

Sunday, October 22, 2006

what happened to Wikipedia accessed in China?

In one second, it worked suddenly for wikipedia's english website after I accessed to it from google searching link; then, suddenly, in one minute, everything stopped working.

I am using the internet connection in Beijing right now. Such a strange behaviour.

I am using the internet connection in Beijing right now. Such a strange behaviour.

Sunday, October 15, 2006

Chinese voice in the blog world

The 2006 Chinese blogger world will be held on Oct 28 to Oct 29 in Hangzhou soon. I believe the conference this year will attract more people from last year dut to the fast growth of the number of Chinese bloggers. Company employees and students are the most active groups in the blog world, while the joining of celebrities, such as their blog in Sina.com, also added more exposure to the blog. I hope it will become a successful conference in which attendees will get what they want. For examples, I overheard that some venture capitalists will attend to look for their investment target....

P.S. Hiking picture last weekend. The Peak in Hong Kong is always fun, no matter when you go and who you go with.

Wealthy Chinese feel no safety

I talked with an assistant of a rich Chinese businessmen on Thursday. He told me his boss is going to finalize his business in Hong Kong at last as the city is more safe. I keep wondering what the businessman is afraid of right now?

Two guess: first, his money is illegal, but from what I know, his business is pretty legal without involving many politics and state-asset stuff. Second, he may be concerned on the safety of his millions of yuan asset, which may be under danger when the whole society lost balance. Seems the second answer is more close to the right answer.

President Hu Jintao has talked for several times on the social harmony. It is a right direction, but needs more solution. This is a target, but behind the social harmony, we should see people's scare. A shanghai financial controller of a state-owned group told me that there is so many bubble in the economy right now, and he wonders how the country will go in the future. His worry does reflect the concern of a lot of people, especially among wealthy class. They have seen their peers fall down and lose their wealth, even their lives, in one night; they also have also sensed the jealous group which hadn't made as much money as them. When Deng Xiaoping allowed a group of people to become richer, he may, or may not, predict that the conflict between the group and the others will be harder and harder.

Under those conflict, China is kind of wandering between the two groups: it could try to stand at the side of the still-poor people, or it could try to protect the already-rich people. It is a hard decision-making process, while no answer has been given out yet. That's why wealthy people ended up in the huge worries.

Glenn Hubbard, a senior economist working with U.S. Federal Reserve and the Dean of the Columbia Business School, said in a recent speech that China's fast growth is highly boosted by the enterpreneurship, rather than from the companding heights. I agreed partly: I agree the commading heights are not well structured to give all transparent policy, but some of them did try to protect the enterpreneurship. Hope more and more officials will be aware of this in the future.

Two guess: first, his money is illegal, but from what I know, his business is pretty legal without involving many politics and state-asset stuff. Second, he may be concerned on the safety of his millions of yuan asset, which may be under danger when the whole society lost balance. Seems the second answer is more close to the right answer.

President Hu Jintao has talked for several times on the social harmony. It is a right direction, but needs more solution. This is a target, but behind the social harmony, we should see people's scare. A shanghai financial controller of a state-owned group told me that there is so many bubble in the economy right now, and he wonders how the country will go in the future. His worry does reflect the concern of a lot of people, especially among wealthy class. They have seen their peers fall down and lose their wealth, even their lives, in one night; they also have also sensed the jealous group which hadn't made as much money as them. When Deng Xiaoping allowed a group of people to become richer, he may, or may not, predict that the conflict between the group and the others will be harder and harder.

Under those conflict, China is kind of wandering between the two groups: it could try to stand at the side of the still-poor people, or it could try to protect the already-rich people. It is a hard decision-making process, while no answer has been given out yet. That's why wealthy people ended up in the huge worries.

Glenn Hubbard, a senior economist working with U.S. Federal Reserve and the Dean of the Columbia Business School, said in a recent speech that China's fast growth is highly boosted by the enterpreneurship, rather than from the companding heights. I agreed partly: I agree the commading heights are not well structured to give all transparent policy, but some of them did try to protect the enterpreneurship. Hope more and more officials will be aware of this in the future.

Thursday, October 12, 2006

Youtube is fun

It's my first time to try the Youtube.com, which was just bought by Google in the stock valued at US$1.65 billion. The website is really funny. Plus, the speed is really good. I always believe a good video website should have fast downloanding speed. The most annoything is to wait the downloading for ten minutes.

Compared with Google with a market value of over US&130 billion, the deal is not that big. Google used this opportunities to add a strong subsidiary, while increase its exposure when every newsppaer makes it the headline. Good marketing strategy.

Compared with Google with a market value of over US&130 billion, the deal is not that big. Google used this opportunities to add a strong subsidiary, while increase its exposure when every newsppaer makes it the headline. Good marketing strategy.

Friday, October 06, 2006

Does TOM really need Eachnet?

Tom Group is said to be in the preliminary talk with Eachnet, the 100 percent owned online auction website owned by Ebay. Though both side declined to comment official, Tom's website already has a link of "Auction", marked in the red color, which forwards visitors to Eachnet. They may have the off-the-table relations for a while, I have no doubt.

As one of the biggest media group in China, Tom group, with the biggest shareholder of Li Ka-shing family, already covered several fast-growing areas in China, including Internet, Outdoor advertisting, Sports, TV and film, and Skype. With its strong capital backup, it is good at M&A to strengthen itself in various sector. For example, it spent US$10 million, half in cash and half in covertible bonds, to get 27 percent to Huayi Brothers, the company making films including the recent-showing The Banquet, and The World without Thieves.

However, it is a question for Tom, already with a online shopping part but without experience on the Eachnet, to help Eachnet to outperform its strong competitor Taobao.com. Last time, I said Eachnet is out of the style because it already among the popularity among sellers. For instance, compared with the laptop sector of the two side, Taobao has over 11000 laptops on sale, over three times than Eachnet with 3600 units. How Tom could beat Taobao, when Ebay couldn't succeed?

I stay concervative on this deal, however, Tom may need a channel of real money, while Eachnet could provide one. Tom's Skype website definitely wants to attract Eachnet's users who already have accounts. The Merge may help consolidate the users, but don't always forget users are also easy to go away after the consolidation.

Good luck, Tom, Ebay and Eachnet. Not sure which investment bank is advising on the deal right now, but please make some good point first.

As one of the biggest media group in China, Tom group, with the biggest shareholder of Li Ka-shing family, already covered several fast-growing areas in China, including Internet, Outdoor advertisting, Sports, TV and film, and Skype. With its strong capital backup, it is good at M&A to strengthen itself in various sector. For example, it spent US$10 million, half in cash and half in covertible bonds, to get 27 percent to Huayi Brothers, the company making films including the recent-showing The Banquet, and The World without Thieves.

However, it is a question for Tom, already with a online shopping part but without experience on the Eachnet, to help Eachnet to outperform its strong competitor Taobao.com. Last time, I said Eachnet is out of the style because it already among the popularity among sellers. For instance, compared with the laptop sector of the two side, Taobao has over 11000 laptops on sale, over three times than Eachnet with 3600 units. How Tom could beat Taobao, when Ebay couldn't succeed?

I stay concervative on this deal, however, Tom may need a channel of real money, while Eachnet could provide one. Tom's Skype website definitely wants to attract Eachnet's users who already have accounts. The Merge may help consolidate the users, but don't always forget users are also easy to go away after the consolidation.

Good luck, Tom, Ebay and Eachnet. Not sure which investment bank is advising on the deal right now, but please make some good point first.

Sunday, October 01, 2006

Warm Springs_a brave president

I am honored to attend the first screening of Warm Springs in Hong Kong this Saturday evening. The producer HBO will show it from October 2. The film tells the story on how Franklin Delano Roosevet, the only U.S. president to serve three terms in U.S. history., win his fight with paralytic illness and finally succeeded. He is brave, optimistic, funny and firm. During the resting period in Warm Springs, the peaceful small town, he learnt his responsbility as well as knew his weakness. A leader would never be perfect, but he will always perfectly know his strength.

The film moved me. Watching together with many people suffering from paralytic illness and the charity gentleman who sponsor the event, I felt the charity event like this is really inspring. Luckily, I am still healthy, but I should be responbile to help those non-lucky people. They are trying their best, and I should try my best to serve them. The world is never perfect, but we should know perfectly what we could do.

Shanghai Media Group_My Shanghai Experience_Part two

Shanghai, as the most fabulous city in the eye of foreigners, should have its own big media group.

Shanghai Media group, set up based on four TV stations inthe city, has about 5200 staff with the asset of 11.7 billion yuan. Big number, isn't it?

As the second-largest biggest media group just following CCTV, the official media group led directly by central government, SMG is trying to expand as a full media corp covering print, radio, Internet, newswires and TV stations. TV is its strongest part right now which contributes all the profit, I guess. They has the newspaper named China Business News, which is also trying to make money though hard. Also do its radio and website. The group also tried to buy a news wires, while unfortunately, no target is available as news wires are so few in China.

Could Shanghai Media Group become really big? the question depends on if Shanghai's strength in media could outperform Beijing. As the international city, Shanghai should try to diversify its media into different fields to meet the needs. For example, Shanghainese, which are always used by Shanghai-origin anchor on the screen, should be banned. People living in Shanghai is from every corner of China and Shanghai should learn the culture of Beijing to accept everything.

Luckily, Shanghai Media Group is trying its best. At least, it has more freedom to expand itself. But how to get rid of the geography restriction is still a question, at least they should change their english website address www.smg.sh.cn/english into something without the "sh".

Shanghai Media group, set up based on four TV stations inthe city, has about 5200 staff with the asset of 11.7 billion yuan. Big number, isn't it?

As the second-largest biggest media group just following CCTV, the official media group led directly by central government, SMG is trying to expand as a full media corp covering print, radio, Internet, newswires and TV stations. TV is its strongest part right now which contributes all the profit, I guess. They has the newspaper named China Business News, which is also trying to make money though hard. Also do its radio and website. The group also tried to buy a news wires, while unfortunately, no target is available as news wires are so few in China.

Could Shanghai Media Group become really big? the question depends on if Shanghai's strength in media could outperform Beijing. As the international city, Shanghai should try to diversify its media into different fields to meet the needs. For example, Shanghainese, which are always used by Shanghai-origin anchor on the screen, should be banned. People living in Shanghai is from every corner of China and Shanghai should learn the culture of Beijing to accept everything.

Luckily, Shanghai Media Group is trying its best. At least, it has more freedom to expand itself. But how to get rid of the geography restriction is still a question, at least they should change their english website address www.smg.sh.cn/english into something without the "sh".

Sunday, September 24, 2006

Taobao is everywhere_My Shanghai Experience_part one

I already came back to Hong Kong. Time flied fast while 22 days just went away in a second.

It's the longest time for me to stay in the mainland China for the past year. I have to admit, things go faster than I thought. China is an amazing country, I would say, in many areas.

Near my place in Shanghai, there is a street where people sell various stuffs along it during the night. For example, pirate DVDs, make-up, and cups. I shopped around for some cheap, really cheap accessories on the street before the day I left. And the experience is really interesting.

"How about the quality of this necklace?" I asked a boy who must be under the age of 20.

"Good, good. It is just transported from Thailand". The boy answered.

"Really? are you sure it is really good?" I asked again, just for fun.

"Yeah, definitely'. He said firmly, then handed out a name card to me with the name for his accessory store, something like "luxury jewlery", and a website address.

"We are a famous store on Taobao.com". The boy answered. "So we will not cheat".

Oh, my god, this is amazing. someone selling stuffs out of the street told me to go to a website to check his stuffs. I wouldn't imagine it before, but now it seems true. He must be not the only person who do it, and I guess there are thousands of thousands of.

That's the amazing thing about Taobao.com, as well as other websites in China. As China is so big, Internet suddenly becomes something businessmen shorten the distance from the customers. I am not a fun of Jack Ma, the founder of Taobao.com, but I would like to say he knows a lot on China's common consumers. I once had a flatmate in Hong Kong who sells her clothes online, and who really likes Taobao.

On the other side, Eachnet.com, the Shanghai-originated website founded by two Harvard Business School graduate, has went out of play these days, at least, told by my former flatmate.

Say, that's the Internet, where Jack Ma, a former English teacher, could beat two HBS graduates. And there will be more amazing things.

It's the longest time for me to stay in the mainland China for the past year. I have to admit, things go faster than I thought. China is an amazing country, I would say, in many areas.

Near my place in Shanghai, there is a street where people sell various stuffs along it during the night. For example, pirate DVDs, make-up, and cups. I shopped around for some cheap, really cheap accessories on the street before the day I left. And the experience is really interesting.

"How about the quality of this necklace?" I asked a boy who must be under the age of 20.

"Good, good. It is just transported from Thailand". The boy answered.

"Really? are you sure it is really good?" I asked again, just for fun.

"Yeah, definitely'. He said firmly, then handed out a name card to me with the name for his accessory store, something like "luxury jewlery", and a website address.

"We are a famous store on Taobao.com". The boy answered. "So we will not cheat".

Oh, my god, this is amazing. someone selling stuffs out of the street told me to go to a website to check his stuffs. I wouldn't imagine it before, but now it seems true. He must be not the only person who do it, and I guess there are thousands of thousands of.

That's the amazing thing about Taobao.com, as well as other websites in China. As China is so big, Internet suddenly becomes something businessmen shorten the distance from the customers. I am not a fun of Jack Ma, the founder of Taobao.com, but I would like to say he knows a lot on China's common consumers. I once had a flatmate in Hong Kong who sells her clothes online, and who really likes Taobao.

On the other side, Eachnet.com, the Shanghai-originated website founded by two Harvard Business School graduate, has went out of play these days, at least, told by my former flatmate.

Say, that's the Internet, where Jack Ma, a former English teacher, could beat two HBS graduates. And there will be more amazing things.

Monday, September 18, 2006

How the China's financial futures market going?

I attended the two-day China Futures International Forum last weekend. The conference was a little bit different from the conferences I attended before, where speakers only talk their own ideas without any kind of Q&A and replies. Compared with other conferences where people could only argue, this conference is more like an investor education course, where attendees could only listen to speeches from overseas stock exchanges, investment banks, brokerages, and academics. Just like a baby, China's financial derivatives are learing how to walk, though slowly, walk.

Wednesday, September 13, 2006

China FX, do people care?

I am attending the two-day conference of the 4th China FX forum held by Euromoney in Shanghai. To my surprise, attendees are not as many as the people I have ever seen for the Euromoney conferences before. Does it mean not many people care, or what?

Here is some update on the coming 2006 Chinese Blogger Conference. As I overheard, they are still short of half of the sponsors. If you by chance know anyone who would like to sponsor it, please contact the organizer. If your company wants more exposure, please try to register it, too. As I overheard again, the attendees of starting companies in 2005 conference have all got funding till now. So good choice for enterprenuers..... Never too busy to attend a good conference.

Here is some update on the coming 2006 Chinese Blogger Conference. As I overheard, they are still short of half of the sponsors. If you by chance know anyone who would like to sponsor it, please contact the organizer. If your company wants more exposure, please try to register it, too. As I overheard again, the attendees of starting companies in 2005 conference have all got funding till now. So good choice for enterprenuers..... Never too busy to attend a good conference.

Friday, September 08, 2006

the newspaper's struggle 2

BTW, it shows people are still interested to read the print copies, isn't it? It feels different when your photo are carried online compared with carried on a print, black-and-white, and famous newspaper.

the newspaper's struggle

One of my interviewees asked me for ten copies of our paper carrying an article on him. (Of course he promised to pay) My first response is like this: "what, ten copies, I don't even have one for me. " Then I calmed down to understand his feelings that he may love the story so much. So I called around to my colleagues in Hong Kong but seems no one had the clue. Their responses are: "Hi, come on, it is an electronic age, and we could send him the electronic copies".

Hmmm, speaking frankly, it is weird for newspaper to say "electronic age", or at least not in a right position. I know most of the newspaper still make money from selling paper copies as well as the advertisements carring on those copies. Then why it is hard to do print print copies specificly, or seems everyone is reluctant to?

As I wrote months ago, newspapers are struggling between the print copies, the main source of profit, and the online copies, the emerging source of profit but still small. How to balance the production in the two area is a hard question for every CEOs managing newspaper. I even read an article from the print copy of Asian Wall Street Journal which is trying hard to attract readers to its charged websites. It is a breaking story, but in the second paragraph( the paragraph in the journalism is a complimentary part to explain the lead in the first one), it says things like this "WSJ. com is the first to report it yesterday". So what? So people should read stuffs on WSJ.com as the print one doesn't carry breaking news.

It is hard. To be fair, WSJ did a good story on how the website of MTV, the most popular music video television station amoung teenagers, failed to attract the same group of audience. Those youths, aged between 15 to 25, preferred more "cool" place such as myspace.com.

I would say it is the problems among all traditional media. They use the traditional thinking to set up an emerging media, which is wrong. They have the expertise, but it doesn't mean they will succeed in the new world. Getting rid of the old, and sometimes arrogant thinking, they could listen clearly on what the users think.

Speaking all things above, I feel a bit of weird, too, as myself is a newspaperer. Anyway, to be fair again, I found something for the interviewee who asked for ten copies of our paper. We do have a website for reprint, though you need to submit a lot of information such as the reason you reprint it. There is still a solution, though I would think it will be exciting if you could order online and then print as many copies as you want.

Hmmm, speaking frankly, it is weird for newspaper to say "electronic age", or at least not in a right position. I know most of the newspaper still make money from selling paper copies as well as the advertisements carring on those copies. Then why it is hard to do print print copies specificly, or seems everyone is reluctant to?

As I wrote months ago, newspapers are struggling between the print copies, the main source of profit, and the online copies, the emerging source of profit but still small. How to balance the production in the two area is a hard question for every CEOs managing newspaper. I even read an article from the print copy of Asian Wall Street Journal which is trying hard to attract readers to its charged websites. It is a breaking story, but in the second paragraph( the paragraph in the journalism is a complimentary part to explain the lead in the first one), it says things like this "WSJ. com is the first to report it yesterday". So what? So people should read stuffs on WSJ.com as the print one doesn't carry breaking news.

It is hard. To be fair, WSJ did a good story on how the website of MTV, the most popular music video television station amoung teenagers, failed to attract the same group of audience. Those youths, aged between 15 to 25, preferred more "cool" place such as myspace.com.

I would say it is the problems among all traditional media. They use the traditional thinking to set up an emerging media, which is wrong. They have the expertise, but it doesn't mean they will succeed in the new world. Getting rid of the old, and sometimes arrogant thinking, they could listen clearly on what the users think.

Speaking all things above, I feel a bit of weird, too, as myself is a newspaperer. Anyway, to be fair again, I found something for the interviewee who asked for ten copies of our paper. We do have a website for reprint, though you need to submit a lot of information such as the reason you reprint it. There is still a solution, though I would think it will be exciting if you could order online and then print as many copies as you want.

Wednesday, September 06, 2006

A new generation of China officials

Talking about Chinese officials, what will you think? someone very old with a pair of big glasses. No, they are a totally new generation, educated in the west and then coming back to China for government career.

Got the leaflet of a finance forum in Shanghai. Reading the officials' resume, I learnt that they are different. Examples:

Mr. Fang Xinghai, Deputy director of Shanghai Financial Services Office

42, PhD from Stanford University, Previously investment officer and the economist of the World Bank

Mr.Zhang Guangping, Director, business Innovation & Supervision Department, China Banking Regulatory Commission

PhD in Economics from U.S., worked in Standard& Poor, Deputy President for JP Morgan Japan, studied in Harvard Law school on securities and banking regulation

Mr. Qi Bin Director for the research center of China Securities Regulatory Commission

MBA from Chicago Business School, worked in the asset management department of Goldman Sachs, Partners in a New York venture capital fund.

And there should be many other in the same type.......

Got the leaflet of a finance forum in Shanghai. Reading the officials' resume, I learnt that they are different. Examples:

Mr. Fang Xinghai, Deputy director of Shanghai Financial Services Office

42, PhD from Stanford University, Previously investment officer and the economist of the World Bank

Mr.Zhang Guangping, Director, business Innovation & Supervision Department, China Banking Regulatory Commission

PhD in Economics from U.S., worked in Standard& Poor, Deputy President for JP Morgan Japan, studied in Harvard Law school on securities and banking regulation

Mr. Qi Bin Director for the research center of China Securities Regulatory Commission

MBA from Chicago Business School, worked in the asset management department of Goldman Sachs, Partners in a New York venture capital fund.

And there should be many other in the same type.......

A new generation of China officials

Talking about Chinese officials, what will you think? someone very old with a pair of big glasses. No, they are a totally new generation, educated in the west and then coming back to China for government career.

Got the leaflet of a finance forum in Shanghai. Reading the officials' resume, I learnt that they are different. Examples:

Mr. Fang Xinghai, Deputy director of Shanghai Financial Services Office

42, PhD from Stanford University, Previously investment officer and the economist of the World Bank

Mr.Zhang Guangping, Director, business Innovation & Supervision Department, China Banking Regulatory Commission

PhD in Economics from U.S., worked in Standard& Poor, Deputy President for JP Morgan Japan, studied in Harvard Law school on securities and banking regulation

Mr. Qi Bin Director for the research center of China Securities Regulatory Commission

MBA from Chicago Business School, worked in the asset management department of Goldman Sachs, Partners in a New York venture capital fund.

And there should be many other in the same type.......

Got the leaflet of a finance forum in Shanghai. Reading the officials' resume, I learnt that they are different. Examples:

Mr. Fang Xinghai, Deputy director of Shanghai Financial Services Office

42, PhD from Stanford University, Previously investment officer and the economist of the World Bank

Mr.Zhang Guangping, Director, business Innovation & Supervision Department, China Banking Regulatory Commission

PhD in Economics from U.S., worked in Standard& Poor, Deputy President for JP Morgan Japan, studied in Harvard Law school on securities and banking regulation

Mr. Qi Bin Director for the research center of China Securities Regulatory Commission

MBA from Chicago Business School, worked in the asset management department of Goldman Sachs, Partners in a New York venture capital fund.

And there should be many other in the same type.......

Monday, September 04, 2006

How China could set up a worldwide financial organization

I was in the 3rd China Finance Forum last weekend. Some speakers are really good and open, while some others are talking on rubbish and wasting audience's time. The last speech from Xu Xiaonian, the managing director of Goldman Sachs Gaohua, the U.S. investment bank's joint venture, however, gave something unique for me to think.

His topic is on how China, the world's fastest developing ecnomy, could set up a worldwide financial organization. He compared the financial sector to the manufaturing sector, and expected some successful private financial organizations will come out to serve the world as Lenovo or Huawei, or ZTE in the manufacutring sector. His basic arguement is that China should continue to open its financial sector as well as introducing managements with international views and incentive salary system to set up world-level financial organizations. He also said that the successful financial organizations will finally come from private sector in which profit is everything, instead of state-owned ones, where management cares more on the employment rate and society stability.

I don't usually believe in economists, especially those in-house researchers, as they always speak for their companies. Xu may have a point saying state-owned companies may not become the worldwide successful onew. I have seen many bankers, or traders from state-owned companies are complaining on their salaries as well as their jobs. but I don't believe the private companies could neglect the employment rate and society stability. As one of the corporate ethics, companies should care about the social principles instead of 100 percent caring on revenue.

Also, I think Mr. Xu may miss another point on the creative culture among the sectors. Lenove as well as Huawei both have their own technology, while now the financial sector in China is only learning from outside. During the conference, it is so common to hear people, from banking to futures brokering, all talking about the difference between China and other countries.

"Now, China is *****, different from the other countries with ****, so that's why China will change".

I am not sensitive on the gap. If China has 1 percent people drink milk, while 60 percent of the U.S. people drink milk, I still don't think China will have 60 percent of people drink milk in the future as China will not become U.S. I believe in China's own character, say, environment, geography, habit, and or so.

That's like the financial sector. We may not have another Goldman Sachs or Morgan Stanley, but we may have a Chinese financial service provider doing different business with investment bankers but succeed in the world. Let's see.

His topic is on how China, the world's fastest developing ecnomy, could set up a worldwide financial organization. He compared the financial sector to the manufaturing sector, and expected some successful private financial organizations will come out to serve the world as Lenovo or Huawei, or ZTE in the manufacutring sector. His basic arguement is that China should continue to open its financial sector as well as introducing managements with international views and incentive salary system to set up world-level financial organizations. He also said that the successful financial organizations will finally come from private sector in which profit is everything, instead of state-owned ones, where management cares more on the employment rate and society stability.

I don't usually believe in economists, especially those in-house researchers, as they always speak for their companies. Xu may have a point saying state-owned companies may not become the worldwide successful onew. I have seen many bankers, or traders from state-owned companies are complaining on their salaries as well as their jobs. but I don't believe the private companies could neglect the employment rate and society stability. As one of the corporate ethics, companies should care about the social principles instead of 100 percent caring on revenue.

Also, I think Mr. Xu may miss another point on the creative culture among the sectors. Lenove as well as Huawei both have their own technology, while now the financial sector in China is only learning from outside. During the conference, it is so common to hear people, from banking to futures brokering, all talking about the difference between China and other countries.

"Now, China is *****, different from the other countries with ****, so that's why China will change".

I am not sensitive on the gap. If China has 1 percent people drink milk, while 60 percent of the U.S. people drink milk, I still don't think China will have 60 percent of people drink milk in the future as China will not become U.S. I believe in China's own character, say, environment, geography, habit, and or so.

That's like the financial sector. We may not have another Goldman Sachs or Morgan Stanley, but we may have a Chinese financial service provider doing different business with investment bankers but succeed in the world. Let's see.

Thursday, August 31, 2006

Arrived in Shanghai

It's my first working day in Shanghai. I stayed in the city for almost two months in the summer last year and then left for Hong Kong. Now, I am like a totally freshed person to the city. No idea how to use subway to go to Pudong, no idea of the humid weather, and no idea of the people here.

Staying in the office, I have a private room, much more comfortable than the Hong Kong office. People here leave office really early, while I still continue working as a HKer, the only one remaining in the office.

Tomorrow will be a big conference. Will be terribly busy. I should have some time to enjoy myself in SH.

Staying in the office, I have a private room, much more comfortable than the Hong Kong office. People here leave office really early, while I still continue working as a HKer, the only one remaining in the office.

Tomorrow will be a big conference. Will be terribly busy. I should have some time to enjoy myself in SH.

Tuesday, August 29, 2006

Another tip from Wiki conference

Jeremy Wales said something quite right during the conference: The block of Wiki will not only inhibit the information flowing into China, but also inhibit the information flowing out of China. Nobody in the mainland China could update the Wiki in the way they want, which means they will not involve in a internationl world where everyone has the right to speak.

A little bit like China's foreign policy right now. No one talks too much. In some extent, it is right; but in other extent, it mean the country loses its freedom of speech to the other countries in the world. Better to think about it.

A little bit like China's foreign policy right now. No one talks too much. In some extent, it is right; but in other extent, it mean the country loses its freedom of speech to the other countries in the world. Better to think about it.

Wikipedia Chinese blogger conference in Hong Kong

The most exciting thing to attend the conference is to see Jimmy Wales, thehedge-fund-manager-turned-non-profit-organization-founder. I am just a huge fun of him. So when i talked with him, I feel I even stammered to speak. bad, bad, bad, just because I am too nervous or what?

I agree with lawrence Li (in chinese) that the conference is a little bit boring, though my job as a volunteer was really chanllenging. Could you imagine doing a real time translation for a five-person panel discussion? Everyone speak fast and love to challenge each other. More terrible, four of the five person are non-native English speakers, and it makes harder to translate other people's secondary language. I was almost crazy. Will never do it again...... just for wiki this time.....

The content in the panel discussion is boring: why Chinese government blocked the wiki? everyone was guessing, while someone tried to explan from a Hong Kong perspective. Most of the speakers, except Jimmy Wales, tried to connect it to the democracy in Hong Kong, and BTW, most of them, except Jimmy Wales, are just occasional Wiki readers or never use Wiki before. The whole topic is a little out of way.... It is more important to talk on some practical topics, say, how to solve the problem, or how to make more mainland Chinese contribute. When a young college student standed up to give his idea which is to set up a version of Wiki without politics, two of the speakers even refused immediately: "You are self censorship yourself". What? at least that young student is thinking of some creative way, not even like someone just sitting there to judge others' creative idea all the time.

Anyway, Jimmy Wales is so cool. And I just like like like him. here is the photo. Am I a lucky girl to be shooted together with him?

I agree with lawrence Li (in chinese) that the conference is a little bit boring, though my job as a volunteer was really chanllenging. Could you imagine doing a real time translation for a five-person panel discussion? Everyone speak fast and love to challenge each other. More terrible, four of the five person are non-native English speakers, and it makes harder to translate other people's secondary language. I was almost crazy. Will never do it again...... just for wiki this time.....

The content in the panel discussion is boring: why Chinese government blocked the wiki? everyone was guessing, while someone tried to explan from a Hong Kong perspective. Most of the speakers, except Jimmy Wales, tried to connect it to the democracy in Hong Kong, and BTW, most of them, except Jimmy Wales, are just occasional Wiki readers or never use Wiki before. The whole topic is a little out of way.... It is more important to talk on some practical topics, say, how to solve the problem, or how to make more mainland Chinese contribute. When a young college student standed up to give his idea which is to set up a version of Wiki without politics, two of the speakers even refused immediately: "You are self censorship yourself". What? at least that young student is thinking of some creative way, not even like someone just sitting there to judge others' creative idea all the time.