Monday, February 28, 2005

How to use "impairment test" on Goodwill?

Though the new accounting standards is just a lagging indicator to test the success of the acquistion, it made the goodwill more transparent to investors and shareholders.

In China, the M&A are more hot this year. The dealing amount of China's M&A are expected to grow up 40 to 50 per cent in value this year, according to a PricewaterhouseCoopers survey reported in February 4th(reported by unlinkable SCMP) . It said that mainland M&As were worth US $52 billion last year, rising up 50 per cent from 2003. China was the largest M&A market in Asia in number terms and accounted for 32 per cent of all deals in the region, followed by Australia and Japan. Will the regulators require "goodwill impairment" to those companies in the operations? I wonder.

Definition of Goodwill: The amount above the fair net book value (adjusted for assumed debt) paid for an acquisition. Goodwill appears as an asset on the balance sheet of the acquiring firm and must be reduced in the event the value is impaired.

The value of learning business journalism

At least not in business journalism. Accurancy and factual is the most important character when reporting a rumor in the market. Yes, reporters should report rumor, but how to report rumor is more important than rumor itself.

A Chinese business newspaper today reported (the story is quoted in Sina.com, sorry in Chinese) a follow story on Shanda's acquistion of Sina.com. The headline is "Shanda bought Sina aiming at cooperating with Microsoft. Wow, it was big news at the first sight. But after reading the story I couldn't find any evidence supporting its headline in the context. The story said that Shanda was planning to get into the market of digital set-up box, a equipement connecting TV and PC(Microsoft tried the marketing several years ago), and acquistion of Sina.com may be part of the plan, according to source close to the company. Also, the Chairman of Shanda visited Microsoft last week, and a senior manager in Microsoft said that there was opportunity to cooperate with Shanda on the digital set-up box. But no people or source said in the story that the acquistion of Sina is aimed at cooperating with Microsoft, nor it could be a condition in the negotiation between Shanda and Microsoft. Then how did reporters get to the conclusion? Just in the three of "A love B, and B love C, so there must be some relation between A and C"?

Reporters are not analysts, partly because analysts could guess or speculate on something, but reporters can't.

That's the reason I am addicted to my business journalism class, where you could know what is good, what is bad, and what you should do in the future.

Sunday, February 27, 2005

How China's economy is exaggerated?

The author said China's economy is much larger than the official numbers show and the growth is unique in the history. He said the U.S Central Intelligence Agency estimated China's economy is the one with a GDP of $6.6trillion, almost five times that the actually reported $1.4trillion in 2003. One of the reason is that local governments are considerably undercutting the growth rate to get more funds and compensation. This is partly true in some poor provinces, but another important fact worried the Central government is the local government officials always reported higher growth rate than the real one, in order to get promoted in the career.

The author also said that China's economy is an enterprenurial economy and will be a bully after listing the example of Chinese businessmen who are making socks or furnitures, the cheap consumer goods. Then he said that cheap consumer goods are only part of what Chinese made. Commercial technology and large Research investment is an advantage for Chinese company to develop. But it is not factual. A story from the Economist introduced by Fons has deeply digged into the technology developed by Chinese companies, which said that foreign companies control virtually all the intellectual property in China and account for 85% of its technology exports.

More expensive raw materials is due to China's growth, said the author. But he should have to refer that it is also China who has suffered from the sharply increase of the prices.

It seems foreign reporters need to do a better job to make the people outside know the truth, the truth beyond the modest Chinese.

Friday, February 25, 2005

Report your competitor

Thursday, February 24, 2005

You journalists always tell a lie

It is hard to tell if it is the fault of the reporters or the interviewees. But the world, including the financial field, seems full of examples.

The dollar's broadly falling down this Tuesday is blamed as the mispresentation by the reporters and market participants. In New York, the euro was trading around $1.3203, up 1.1 per cent from Monday. Also against the yen the dollar was down 1.3 per cent to 104.20 yen, according to Reuters. Many traders seized on the news from the Bank of Korea(the Central Bank in South Korea), that the bank may "diversify the currencies in which it invests", as a convenient excuse to sell dollars. The bank, however, said that its statements had been misconstrued. It has no plan to sell dollars, according to Kang Myun Mo, director general of reserve management at the bank, reported by Asian Wall Street Journal. But the sentence of "diversify the currencies in which it invests" is indeed easy to be misunderstood in such a sensitive environment. Fortunately, a better-than-expected January consumer prices data partly saved dollar on Wednesday, while the bank directors in Asia, including Japan, announced that they had no plan to sell dollars.

The same thing happened to General Motors Corp, the world's No.1 auto maker, today when a Swedish nespaper named Dagens Industri said that the company was looking for a buyer for its loss-making Swedish car brand Saab, reported by Reuters and other media. The newspaper quoted a source with a good link to GM. Later today, GM blamed the report in the words- "the rumor is totally preposterous", though it admitted that Saab needed to improve its performance. It is difficult to judge now if GM told truth or not, but it is now facing a stronger competitor in US, where it is based, when the Japanese Toyota will lately set up more assembly plant there. There is a chance that GM curiously needs plenty of cash to protect its based market.

The tricky of "separately"

There is an example in yesterday's Asian Wall Street Journal-"China's producer prices rose 5.8% in January". After telling China's producer prices rose 5.8% from a year earlier in January and the increasing details, it reported:"Separately, China's agricultural sector posted a trade deficit of $4.64 billion last year, compard with a surplus of $2.50 billion in 2003". The story should be read as that China's agriculture has began to depend more on the importing, while the producers price, including prices of raw material, fuel, and power, rose in the industry whose current exporting is more than importing.

In fact, more importing is not always bad, but compared with the latest Consumer Price Index, reported by the National Bureau of Statistics, we can't be too optimistic. The CPI in rural area was up by 2.8% over the same period of last year, twice the growth of the one in urban area. The price of food rose up by 14.2% over the same period of last year, compared with 78.2 per cent falling down of the exporting(link to the report from the Ministry of Agriculture, sorry in Chinese) . It is, in fact, the importing business has benefited from the rise of the price, not the Chinese farmers in the rural area where the CPI rises further.

More and more farmers coming to work in the factory, may lead to the sharply falling down of exporting food. They are attracted by the higher salary in the city. According to the survey of the National Bureau of Statistics(in Chinese), the average income of farmers has risen up by 6.8 per cent to 2936 yuan, eight-year highest since 1997. It remains to say whether the trend will continue as the competition between factories become more serious.

Tuesday, February 22, 2005

Could BlogChina become a news agency?

fewer guys in Hong Kong

The reported figure of male is 3.3145 million at the end of 2004, 10 thousand fewer than the data in the middle of the year. The number of female grows up by 1 per cent to 3.581 million. The female is now 3.8 per cent higher than the male.

One reason is that many mainland females (including me) come to Hong Kong, pushing the figures up. But it can't explain the decrease of the males. An aging population is the real problem, according to Chief Secretary for Administration Donald Tsang. He encouraged Hong Kong's young couples to give birth to more children, to say, three. But to my observation, they are too busy to prepare for the birth of the children and the time to raise them up. Tsang said the government would try to attract many young males to balance the gap. But will the step solve the problem? I am cautious about the answer. But many of my male friends should be happy at the Tsang's new step.

Monday, February 21, 2005

Sina good at maintaining investor relation?

The case is shunned from the Chinese news media in the excuse of protecting the local company, according to Keso, a famous domestic blogger specialised in IT. But another Sina-related news, that Shanda Interactive, a leading online game company in China, has bought 19.5 per cent of Sina shares and become the biggest shareholder are discussed hotly. Both parties, including Sina and Shanda, kept low profiles on the deal. Sina said on its website that "it had been informed" the news when Shanda Interactive have filed a Schedule 13D(a required document when a group acquires beneficial ownership of more than 5% of a company) with the United States Securities and Exchange Commission, which leaded many Wall Street analysts saying the deal was "most likely done without Sina's knowledge", according to Reuters.

One popular speculation in the market is that Shanda wanted to set up its dream of "entertainment emperor" based on Sina, a leading online media in China. That's the reason why Shanda progressed its unsolicited bid via its large amount of cash flow, without noticing Sina. At last, Sina's management and board had to accept the result. Sina played a word game in its press release saying that the only action reported in the filing is the purchase of shares has no direct effect on the company shareholders. Of course, what indeed matters is Shanda and Sina's future actions.

Till now, Sina has acted most like a victim of the unsolicited bid, though the investigation, especially from US shareholders, is still going on. The accurate timing of the deal is one of the suspected reason. Shanda bought 14.4% per cent of the shares, above two thirds of the whole shares, at the price of 22 to 24 per share, through open market, just a day after Sina's annoucement which leaded to the price's fall. The share price fell down 16 per cent after it announced the fourth quarter report.

But in fact, Shanda began its acquistion before January, the disclosed starting time in its SC 13D to SEC. It owned almost 3.2 per cent of Sina's shares, which is 1,600,890 shares besides the shares it bought through January to February. In the document, Shanda has bought 8,220,875 shares from Jan.12 to Feb.10. But it didn't disclose the time they got the 3.2 per cent shares and the price.

Separately, a dozen of Sina's directors and officers has disposed of their shares or share options after the company announced its profitable third quarter report in October 27, according to SEC's trading reports. Yan Wang, the director and CEO of Sina, has earned almost 5 million US dollars using his priority stock options in Oct 29 and Nov 19. Chiang Daniel, another director, has transferred 277,500 shares, to the account of his wife, son and daughter on Dec.8, a month before Shanda's disclosed acquistion date.

Rumors said that some of Sina's management has helped Shanda to complete the deal. If it is the truth, Sina would suffer from the suit with its shareholders in US, with the crime to help Shanda to buy the shares in a fairly low price and not tell the truth to the investors. In some extent, the case and the subsequent loss will teach Chinese companies how to maintain a right investor relation.

Sunday, February 20, 2005

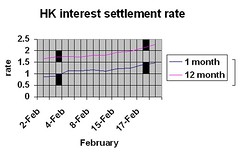

HK interest settlement rate grows up while regulator urges the surge of interest rates

But banks are still cautious at raising up the interest rate, though the rising settlement rate makes them earn less from the borrowers under the current agreement

Under the Forward Rate Agreement, or FRA, Hong Kong banks and the borrowers has locked in an interest rate for a stated period of time starting on a future settlement date. The borrowers could use FRA to protect itself from a future increase in interest rates. The banks could protect itself from a future decline in interest rates. When the settlement rates, which is updated by the Hong Kong Association of Banks every day, is higher and the interest rates remains unchanged, banks have to pay the interest differential to borrowers. Further details and calculating methods could be reached here.

Hong Kong Monetary Authority, has urged banks to raise the interest rate to peg the growth of the US interest rates, in order to prevent the sudden and large amount of capital outflow when bank raise the rates. Joseph Yam Chi -kwong, Chief Executive of HKMA, hinted of future interest rates rise on Feb 4 and more directly urged banks to rise their interest rates on Feb 17. The settlement rate stopped rising for several days after his first speech(see the grid marked black in the picture), but continued rising shortly.

The authority wants the market acting in a gradual and soft way, while banks are going after the profit as most as they could. It is like a pull-and-push game, where borrowers need to pay close attention to win.

Friday, February 18, 2005

how to measure the size of the banks?

That's a pretty hard question to Amy, though her major interest in the business class is "banking". Amy is a hard-working girl, so she went back to search. She checked the statistics from the government, saying that the number of the licensed bank at the end of 2003 is 133, the restricted licensed bank(the former so-called "licensed deposit-taking company" is 41, and the deposit taking company(the former so-called "registered deposit-taking company" is 39.

But Amy could only find a list of 80 banks in Hong Kong with their contacting numbers. Then the question came to the mind: How about their ranking list?

HSBC is the largest bank incorporated in Hong Kong, officially said its website.

Hang Seng bank and Bank of China(Hong Kong) are competing for the second place, while the first announced that "it is the second-largest listed bank in Hong Kong in terms of market capitalisation". BOC(Hong Kong) is comparatively low profile, saying it is a leading commercial banking group in Hong Kong in terms of assets and customer deposits. A former report from People's daily confirmed that BOC(Hong Kong) is the second largest bank in Hong Kong in terms of assets.

It is hard to say who is in the fourth place. Standard Chartered Bank(HK) said that it was one of the three note-issuing banks besides HSBC and BOC, but is reluctant to tell its rank. While the unlinkable South China Morning Post reported that Bank of East Asia is the fourth largest, the modest bank said that it is only the largest independent local bank in Hong Kong.

So it seems that we can't simply rank the local banks without "in terms of".

In the reporting season, the Bank of East Asia is the first to report the annual result, with earnings growth of 26.1 per cent for last year, which was seen as the good sign of the coming results from the Hong Kong banks. Standard Chartered has unveiled the higher-than-expected result this Wednesday, which helped boosting the banking shares. At the same day, index heavyweight HSBC Holdings plc, due to report its full-year results eleven days later, rose 0.38 percent to retest a seven-week high of HK$133.50 first reached on Wednesday, contributing the blue-chip index closed at 14,017.23 points after hitting an intra-day high of 14,043.94, its highest level since January 4.

The Hang Seng bank will release the result the same day with its parent HSBC, while BOC(HK)'s report date couldn't be found on its website.

While Hong Kong market is celebrating for the bullish bank share, Standard Chartered suffered with a 1.2 percent fall in the UK market yesterday, as analysts said its shares looked overvalued.

Wednesday, February 16, 2005

CEPA and WTO

Separately, a two-day seminar called "China's Participation in the WTO: Changing China, Changing the World" will be held in Hong Kong three days after the Geneva meeting. The attending People will include Shi Guangsheng, former Minister of Commerce, Shi Miaomiao, Deputy Director in WTO Division of Ministry of Commerce, Huang Rengang, Counsellor in Permanent Mission of China to the WTO and etc. The topics vary from "China's progress in building the new foreign trade regime" to "Multilateralism versus Regionalism".

Anyone interested in the seminar can leave a message to Amy to ask for the registering details. Amy is interested, too, but the price is too high to afford, 1500 HK dollars for each of the half-day session. You may have enough money for it.

Sunday, February 13, 2005

An important year for Chinese banks

Chinese people always consider the first day after the Lunar new year as the beginning of the year. Most companies settle their accounts until the last day of the Lunar new year holiday and grant bonus to the employees as holiday presents. The same happens to the Chinese banks. They will have to progress their urgent plan for the new year when the employees come back from their holiday. The time for Chinese banks to develop themselves is limited because the limitation for foreign banks in geographic coverage, clients and licensing will be removed next year, five years after China's accession to the WTO.

The plans for the previous years have already been processing in a decent manner, like the privatization in the Bank of China and China Constuction Bank. Both are most likely the first two state-owned bank to go listed overseas this year. But the corruption scandals happened lately in the BOC made the managements so embarrassed that they refused to say more about the IPO, which possibly means that the two banks have already got the admission from the regulating authorities before the scandals could be aware of.

The other two state-owned bank, Industrial and Commercial Bank of China and Agricultural Bank of China, are curious to get up with the first two. ICBC will begin its privatization this year, though the details of the operation haven't been decided, according to Sina(Link in Chinese).

At the same time, Agricultural Bank of China has already handed in its second version plan to the authority, but may hardly get the approval in the short term.

The private banks are more aggressive in the IPO, aiming at attracting international investors as soon as possible. Two pioneers, the bank of Communications andChina Minsheng Banking Corp. Ltd, are planning to go listed in Hong Kong at the first half of the year.

City commercial banks don't want to fall behind in the IPO fashion this year, especiall the banks in the big cities. The Bank of Shanghai, who has introduced HSBC as its second biggest shareholder, is planning to go to the A share and H share market before the end of the year. Also, the Bank of Beijing planned to be invested by internatioal organizations this year. But to most of the city banks far away from the helm of politics, it is hard for them to reform themselves shortly because of the different policies in provincial government. Most of them are still in deep trouble, according to a previous story.

Fund management is considered as a new profitable business to many banks this year, besides the listing plans. According to Sina(Link in Chinese)'s report, the Industrial and Commercial Bank and the China Merchant Bank, are possibly the first two to get the license. But the problem is how to regulate the banks if they could both operate the fund and the other financial services. Will "fire walls" between different services be set up? If not, the fund management business could not be developed well with many possibly scandals.

The Chinese banks will surely be busy at their privatisation plan including IPO and fund management this year. But the internal management efficiency and productivity are also important to the bank reform. According to my personal experience, I once met a woman employee from a city branch of ISBC on a travel bus. I felt strange that she could freely travel on a working day. She said she could easily get leave from her company to do some private stuffs. I was surprised and then asked if her company had already faced serious competition. She sighed and said "We are state-owned, which has limited our advantage to compete with others".

Wow, what kind of advantage, then I wonder.

Back to my writing

I told myself "Amy is not a soft girl" and tried to enjoy the life in the city. I visited a friend in Discovery Bay, a beautiful island near Hong Kong. The place is peaceful with children playing in the plaza, bird singing in the tree and lovers sitting together beside the sea; The place is also strange that "it is, in fact, not part of Hong Kong", said my friend. But the peace is always based on the money. My friend's 120-square-meter flat costs them 90 thousands HK dollars per month, which almost equals with the salary of a school professor. Besides the Peak ( the place where the most rich men lives) and the Central (the place with the most expensive office), the expense of Discovery Bay may rank as the third in Hong Kong.

Back to the "actual" city, there are more activities where grassroot people could enjoy, like "Flower market"(a special place for people to buy and sell things under the sky) and fireworks. Dozens of thousands people came outside to enjoy the new year air, when I stayed in my small flat to enjoy my favorite song:

"Always afraid of missing you when I am alone,

always afraid of hearing of your news,

The end of the way of love is departing, though,

I would still choose to walk ahead"

I always tried not to write my personal feeling and pretended to be more "professional", but I can't help to writing this time. Because the days are special.

Saturday, February 05, 2005

shareholders lost money after Citicorp merging with Traverlers

It is important not because the companies are both big, but also because the former merge between Travelers and Citigroup, both forming Citigroup in 1998, is so affected that a law was created to allow banks and insures to merge in the next year.

According to the report on New York Times on April 4th, 1997, Wall Street Traders were excited on the merging news, which helped boosting Citicorp stake rise about one fourth to US$180.50 and Traverlers rise one sixth to $73.

Then the two executives decided to merge the two companies into Citigroup. There is no money exchanging from hands, only share exchanges for the shareholders. The Citicorp shareholders will get 2.5 shares of the new comany for each of the holding shares. The Traverlers shareholders will remain equal certificates.

Suppose I was the shareholder who bought the Citicorp share in cash on the day the merging news published and kept the later-Citigroup share till the last day of January 2005, I would lose 57.875 US dollars for each of my original share, almost one third of the original price.

Suppose I was the shareholder of Traverlers who bought the original share in cash and keep it for the time of seven years, I would lose 23.95 US dollars for each share, also one third of the original price.

Unfortunately, I haven't seen any media including Reuters and Bloomberg comparing the wide range of the share price.

Wallen Buffet told us to invest in the good company for long term profit. But it is not true in the Citigroup case, though it is still a respected company in its field. Unfortunately, shareholders will probably not get additional dividend, though Citigroup will get almost around US$10 billion dollars in cash in the deal. The company said that it would only consider to boost the dividend as one choice among the total three ones, while the two other are reinvesting in more profitable businesses and buying back stocks(Oh, I have already lost one third).

Friday, February 04, 2005

Big gift for the executives in China Netcom

For example, PCCW's future new deputy Chairman from China Netcom Group will get the compensation more than 2.5 times of the total estimated compensation for all the directors in China Netcom BVI( the HK-listed company, controlled by China Netcom Group) , if he can get the same level of compensation as the other PCCW's diretors.

China Netcom said on Jan. 20 that one of its three directors, who will join PCCW's borad, will become a Deputy Chairman of PCCW . According to PCCW's annual report 2003, the compensation for all the top three executives, including the Chairman and the other deputy Chairman is higher than 10,500,000 HK dollars.

In China Netcom BVI's prospertuses last year, it said that the total compensation of all its directors in 2004 will be about 3.8 million yuan, two fifth of the amount PCCW pay the single director.

Wednesday, February 02, 2005

Google's revenue doubled to 1 billion US dollars

The result has beated the analyst's estimate profit that an analyst said that " "Revenue is well ahead of anybody's expectations."

It should be interesting to see how much the world advertises spend these year and how much the traditional media has lost.

It is also interesting to do some research on how many percentage of people will click to advertising link when they use Google or Google adsense.

a brief translation of a report investigating the city banks in China

Feb 2, from Sina

Central government has released the investigation report on 20 city commercial banks at the end of January.

The large bad loan is the biggest problem for those banks. The percentage of the bad loan for those banks is about 14 %. But the money they have handed in for the bad loan is only about 6 billion yuan, almost 60 million less than the moeny they should keep.

<>While the loan syndicate percentage in most banks has already exceeded the international warning line, the banks are lack of the valid regulation of the risk management. Many of the regulation are null, or set up only to be checked by

<>

Tuesday, February 01, 2005

yuan may probably not be revalued in the short term

The two things seems unrelated at the first sight. But we can relate to both in some circumstance.

First, where will Ping An, or its probable adviser Alliance Capital invest its 1.75 billion US dollars? It may not a difficult question for the companies to answer the question, especially Alliance Capital, the global fund management company with different portfolios for different customers.

But now it seems that many fund managers are putting more and more money in mainland China and Hong Kong. According to an inverview conducted by unlinkable SCMP, the chief executive of the Standard Charted Bank said that half of the money flowing in China are "hot money", seeking higher profit than what they could get from other places.

Hong Kong is another place for U.S. fund managers to invest, according to one of my previous stories.

So it means that Ping An will probably invest part of its investment, in the yuan currency, back into China, under the suggestion of Alliance Capital, because the return is possibly higher than other places. Ping An 's money will surely experience two exchanges: First Ping An exchanges yuan for US dollars from Central Bank, then Ping An exchanges US dollars for yuan if the money invest back to China.

No one will lose in the process if yuan remains its value. But things will be different if yuan revalue in the future. If yuan is up by 0.01 per cent, it means that 17 million yuan will disappear in the reality only from the process of two exchanges. Of course, Ping An doesn't want to see it, nor did the other two insurers, China Life and PICC.

Also the National Social Security Fund (NSSF) 's 170 yuan will be prepared to invest outside China.

It is hard to say who will benefit if yuan is revalued, but it is easy to know that all the Chinese investers, who has already put their money on the overseas markets, will lose on the circumstance.

Why fund management company cooperate with issurance company?

While he didn't reveal the terms of the cooperating, his words could partly show the purpose of the joint venture.

(1) "I do think the joint venture...will allow us to provide our asset management experience and knowledge to our partner"-Mr. Sanders

Hong Kong-listed Ping An, the second largest insurer in China will probably be advised by Alliance Capital to invest its US$ 1.75 billion overseas. It has been approved by the State Administration of Foreign Exchange in January. Ping An, definitely, needs a global partner to improve its investment skill. Alliance Capital also will benefit from the management of the large amount of money.

(2) "We have to get the first-hand knowledge of the Chinese market to our fund managers around the world to ensure we can continue to be a successful fund management company globally"-Mr. Sanders.

The evaluating of the risk when investing in mainland China will surely on the agenda of every fund managers. They want to be a pioneer in analyzing the market because only a few fund management companies has already been in China. The news reports obviously don't satisfy the managers.