Thursday, April 28, 2005

Human Resource_Who will you recruit?

"I have met 28 year olds in India, China and Eastern Europe with IQs of 150, MBA degrees (as good as ours), an 80 hour per week work schedule and a salary of $20,000 per year. In the US for $20,000 you can get a bag boy with an attitude problem."

I believe that's the reason why many US investors rush to China, and why many Chinese elites stay in US.

Economy_Why Japan said sorry?

Take a look at Japan's economy. It has experienced deflation for seven years, and fell into recession last year as exports faltered and consumer spending stalled. The Bank of Japan today held borrowing costs at almost zero to support a recovery in the world's second-largest economy. The industrial production unexpectedly declined in March, reported Bloomberg.

A former diplomat in Japan said in a story on Japan Times that Japan must maintain its quiet and patient stance toward China and support the Chinese people in their struggle to become a wealthy and democratic nation. But that's only official diplomacy words. The real words is that Japan and China are neither strong enough to oppost at each other: Japan, the second-largest economy in the world, now suffered from a seems-never-ending recession, while China has tried to cool the over-heated economy.

So, soilders rest.

Wednesday, April 27, 2005

Media_Different judgement on China Southern Airline's annual report

So here is the story. When China Southern Airline, China's second-biggest airlines by sales, disclose the annual result of 2004, a Hong Kong local newspaper reported the result in a net profit of 94 million yuan, while Bloomberg, a financial news wire, said a net loss of 48 million yuan citing the burden of surging oil costs.

Amy is curious to dig into the company's website to get the real result, and it is here. Bloomberg is right that the Airline lost money last year, while the unlinkable South China Morning Post is totally wrong.

The PR person in the China Southern Airline might be happy to see the story on the largest local English newspaper. They may careful cut the story down from the paper and post it on their own records, with some note such as "Our great PR job".

The reporter in the newspaper said that the mistake is caused by his inexperience in reading simplified Chinese, which is in different form from the popular traditional Chinese in Hong Kong, though I would like to call it an "unavoidable" mistake in the newspapers.

Newspaper itself suffers most from the popularity of online news and blogs. Michael Eliott, the Editor of Time Asia, said that he already knew newspaper will be the victim in the Internet era, instead of the magazine, because the latter's quality is better. Newspaper's revenues grows up slowly, leading many experienced reporters leaving for other better-paid positions such as Public Relation person and financial analysts. In that case, how you expect some entry-level or inexperienced reporters to bring in-depth or right stories to the readers?

If the circle is like that, guess what will happen at last?

Tuesday, April 26, 2005

Politics_Reread China's anti Secession Law

In the article 7, it says that the consultations and negotiations towards reunification may be conducted in steps and phases and with flexible and varied modalities, which is unique in the usually strict laws in China. The words "in steps and phases", "flexible" and "varied" shows that Chinese Communist Party is willing to negotiate with Taiwan in a large scope, without forcing it followiing a fixed schedule.

Article 7 also said about the six issues in the negotiation, including "officially ending the state of hostility between the two sides", "mapping out the development of cross-Straits relations", "steps and arrangements for peaceful national reunification", "the political status of the Taiwan authorities", "the Taiwan region's room of international operation that is compatible with its status" and other matters concerning the achievement of peaceful national reunification. Though time is limited for Lien to fix all issues in this trip, the three books as presents from KMT to CCP may try to explain KMT's idea in a more vivid way. The books include(in Chinese) a book on Taiwai's history written by Lien's grandfather, another named "Hope only after change" written by lien himself and a new one named "Lien's 2005 trip to mainland". The second one gave a clear idea about Lien and KMT's point towards reunification.

Lien asked for the possibility to re-negotiate shortly after the pass of anti secession law. In March 15, one day after the pass of anti-secession law, Lien said(in Chinese) that Taiwan and mainland must go back to the status of "no independancy, no war" with the gradual solution in the peaceful time from 30 years to 50 years.

Chinese media praised highly on Lien's trip, remaining me wonder if Lien's books will be published in mainland in the near future.

Bank_Morgan Stanley is still working, huh?

The stock(ticker symbol MST) is Capital-Protected Notes based upon the S&P MidCap 400 Index, with the amount of $8 million, and has a maturation date of October 30, 2010, while the equity(Ticker symbol DJL) is Performance Leveraged Upside Securities linked to the Dow Jones Industrial Average, with the amount of $15.5 million, and matured at April 30, 2007.

Last week, eight senior traders in Morgan Stanley has left for Deustche Bank, which hinted that Philip Purcell may have underestimated the extent to which the brokerage firm's top traders and bankers have remained loyal to their former bosses.

It is common that a company's rival always put the in-crisis company's employee on the radar screen. But it is hard to know what will be the result of the crisis in this white-shoe brokerage. Will Philip Purcell leave at last under the pressure that more and more elite trader and broker are leaving?

Sunday, April 24, 2005

Bank_good or bad to invest in city commercial banks instead of state-owned ones?

The purchases are explained as many foreign banks' rush into Chinese market before the end of 2006 when foreign banks are allowed to conduct local currency business with individuals. Last month, Netherlands_based ING Groep NV took a similar-sized position in the Bank of Beijing as Commonwealth did to the Hangzhou bank.

Asian Wall Street Journal quoted bank analysts saying Commonwealth looks to have adopted a smart strategy, although it is early to say. But many overseas investors think smaller city commercial banks in China could open a door to China for them and less riskier compared with investing in large state-owned banks such as China Construction Bank and Bank of China.

But city commercial banks in China do have their own problems. The high ratio of bad loan is one of them, while their main attention on short-term profit is another, according to a translated story from Sina.com(in English).

Good luck.

Economy_Revaluing the yuan, for the sake of economy or the politics?

``If there is more pressure from outside, it will force us to speed up our reform,'' Zhou said at the Boao Forum in southern Hainan island yesterday, reported Bloomberg. Zhou said China welcomes international pressure because it will force the nation to speed up needed financial reforms. Still, ``we don't see that the pressure is that strong right now,'' he said.

Two days before, Federal Reserve Chief Alan Greenspan said China should loose the peg between yuan and U.S. dollar for China's good sake, without saying the peg caused the large deficit of U.S.. He said the economic pressure said the growing economic pressure will compel China to alter its policy of pegging its currency to the U.S. dollar at some point, and the sooner it happens the better. "The sooner they move off this fixed (rate), the better off for China's economy." Reuter reported.

The manufacturers in U.S. and other countries has argued that the peg of yuan to U.S. dollar gives an unfair disadvantage for Chinese products selling overseas. U.S. Treasury Secretary John Snow repeated at the same day that the new, tougher administration line on China, saying the country has taken the necessary steps to handle a flexible currency now.

"Hard fist first, and then soft words", says an old Chinese saying. That's what the nations who want to push China loose the peg did.

Thursday, April 21, 2005

Telecom_Who is Hou Ziqiang?

Hou Ziqiang, a professor in Chinese Academy of Sciences, said that "China will require investment of 200 billion yuan to switch completely to 3G (third-generaton mobile networks)", reported Reuters. He also said that the 3G roll-out will come after a highly anticipated industry restructuring that some believe could reduce the current field of four major players to three.

Hou, 67, the decade-old Chairman of China Kejian Corporation, a manufacturer making mobile-phone in China, resigned last month. He is now the independent non-executive director of Hong Kong-listed China Netcom(Hong Kong), the second largest fixed-line telecom company in China, and reported as the top science advisor of China Netcom by local media.

A long-term supporter for the reform in Chinese telecom industry, in both regulating infrastructure and free market competition, Hou has been active in the discussions on the topic such as merging regulators in the telecom and media industry in the same way as Federal Communications Commission in U.S. did.

His words came unexpectedly facing the uncertain restructuring plan to the current players. If Hou is right that restructuring will come before the investment of 3G, then how come he knows the exact number of money spending on 3G before the restructuring? Or the restructuring has already been progressing without noticing?

Unfortunately, this piece is not favored by the media in China, where I couldn't find anyone report it yet. In some extent, it shows that Hou's words may be true, or too sensitive.

Wednesday, April 20, 2005

Manufacture_GM China, bright or not?

GM China said it earned US$33 million in the latest quarter, down sharply from $162 million a year ago, though the market share grew to 10.4 percent from 9.9 percent last year. It said in the report that the environment in China is more challenging without elaborating. But numbers show that the market is not that profitable as it was last year.

Phil Murtaugh, the Chairman of GM China for more than four years, resigned last month in what is understook to be a disagreement over management strategy. He has been succeeded by Kevin Wale, perviously head of GM's British unit, Vauxhall.

Still a long way to go.

Asset_50 billion NPL sold

The ten packages were part of more than 50 billion yuan, or about US$6 billion, of distressed assets auctioned by China Orient. In March, China Orient's annual report said it would sell the nonperforming assets of 50 billion yuan by the end of the year, getting back 5.5 billion yuan, or about US$600 million, which accounts 11 percent of the total assets.

The 19 investors included foreign investors such as Deutsche Bank AG, German's largest lender, the Credit Suisse First Boston Inc, a unit of Zurich-based Credit Suisse, Switzerland's No.2 bank, J.P. Morgan Chase & Co., U.S's second biggest bank , Hong Kong-based Pacific Alliance Group, Mellon HBV Alliance Group in New York and London, and local investors from Shanghai, Anhui Province, Hubei province.etc. (China daily has mistaken J.P. Morgan with Morgan Stanley in its story) . Details for each investor are not made public.

Non-performing asset has been a barrier for Chinese companies, especially commercial banks, in China's financial reform. In 1999, four asset management, including China Orient, China Huarong Asset Management Inc., China Xinda Asset Management Inc., and China Great Wall Asset Management Inc., were set up to manage the separated nonperforming assets from commercial banks to push banks listed in overseas market.

China Banking Regulatory Commission reported on April 18, a day before China Orient's selling, that four asset management companies has sold nonperforming assets of 688.55 billion yuan, or US$67 billion, accounting for about 20 percent of the total assets, till this March. The assets China Orient sold are 106.7 billion yuan, or 22 percent of the total sold assets, ranked as second among four companies after China Xinda.

Tuesday, April 19, 2005

Gamble_Where you want to gamble, Singapore or Macau or...?

“We cannot stand still. The whole region is on the move,” Lee was quoted by Reuters as saying. “If we don’t change, where will we be in 20 years?”

A website named Casino City has kept a full news list on the process Singapore government made a decision on the gambling legalization. Asian Wall Street said that Singaporeans already spend an estimated S$2 billion, or US$1.2billion, gambling abroad each year including on cruise ships that ply waters just off Singapore, and in Genting Highlands, a casino in Malaysia. Nearly 20 operators, most from Las Vagas, submitted concepts for what Singapore calls an "integrated resort". The new casino resorts will be likely open around 2009.

The reason why giant gambling operators eyeing a Singapore license is that they are not easy to get a license in Macau, the biggest gambling Asian city after Las Vagas in the United States. The government in Macau, the only city in China where gambling is legalised, has already granted three licenses to Macau tycoon Stanley Ho's Las Vegas Sands Corp. , Wynn Resort Ltd and Galaxy Resort & Casino.

One day after the Singapore government legalize the gambling, Galaxy Resort & Casino, one of the three casino operators in Macau, will be sold to the Hong Kong listed company-K. Wah Construction Materials Ltd. for HK$18.4 billion ($2.4 billion) . Both companies are owned by Hong Kong tycoon Lui Che-woo. Galaxy is likely to be the first traded gambling company in Hong Kong.

Lui's family ``needs the money to build their two planned casino resorts,'' said Karen Tang, a Hong Kong-based analyst at Deutsche Securities Asia Ltd, quoted from Bloomberg ``They are using the stock exchange to do that.'' Now, it needs to compete with Singapore, too.

Officials in Hong Kong, the competing city with Singapore in tourism and finance, said on radio that they will not open the door to the gaming industry though Sinapore did that.

The prime minister in Singapore said tourists now stay only for three days in the city, one day less compared with they stay in Hong Kong.

A Chinese friend who first went to Singapore last month told me that Singapore is comfortable with most people speaking Mandarin. "But compared with Hong Kong, it is boring to see so many building with same height, and the newspapers there are not that interesting, too." She said.

Opinion_Other bloggers' opinion

Opinion_review comments from dear readers

I talked about Patriotism in China in my story, but the point was disagreed by many readers such as Dave, Joann, Shulan and one or two annoymous people. I agree with Shulan that "Patriotism also is a mighty political weapon " in the perspective of politics, but my point is in the view of common people.

When People's Republic of China was firstly set up in 1949, people believed that China will finally develop into a Communism society, where all people could live a happy life with average living necessaries; Then in 1950s, people lived a hard life caused by natural disasters. Some people even starved to death, though they still held firm belief; In 1960s, when everything was about going back to normal, Cultural Revolution came. People's feelings and belief were strongly hurt, while some of them expected the Spring coming soon; Ten years later, the disaster went away. Chinese people found that they have lost so many time on the political fighting that the economies in other countries such as US and Japan have already been quite stronger. Some leaders created policies to push the nation's economy, though most of the policies are hard to implement under the heavy political pressure. People's belief was wandering between Communism and Capitalism, while the youngers such as students began to suspect. After 1989, government solidened its power, while different beliefs among the people were totally beaten. Fortunately, economic reform has attracted people's attention, with some extremists saying "Money is everything". Until now, I would like to say only patriotism remains under these years. That's good, in some extent, that something is unchanged

I could agree with Dave many people did wrong in the cultural revolution, but it is a quite different era when everyone talks about politics. 無塵工作室(the dustless workshop) is right saying that most Chinese don't really care much about politics at this time because they firstly want a better life. In the cultural revolution, hope everyone knows, all the living necessaries are from the government, and totally free to every people, which I think is amazing for a start-up government to achieve. But now things are different. Being Poor and rich depend on your effort, and no government, including China and other countries such as US, will promise that to their people. Dave is afraid that Chinese people will do the same thing as their parents or grandparents did in the Cultural Revolution, but come on, they are under totally social contexts.

One thing is dangerous, I believe, is the point from an annoymous reader saying that "Wake up, China" or "help the people of China" in the comments. I am sorry but I couldn't quite understand your point because it seems like Chinese people were now living a bad life. You could say the same words to some others, like those people in South Asia who suffered from Tsunami, and then they of course, will say thanks to you. You could try, one day, to tell some Chineses living in the nation or overseas that "I am here to help you", and to see their response. Remember to update me because I am curious to know the results, too. Thanks.

One thing I would like to say is that I am sorry to those Japanese suffered in the protesting. I appologize for those violence happening in the protesting, especially if some Japanese are hurt in those cities. Peaceful protesting is acceptable, but violence isn't tolerated.

Monday, April 18, 2005

Media_Caijing, business magazine for politics?

Quote:

"Caijing has a good reputation pushing the borders," says Perry Link, a professor of East Asian Studies at Princeton University who has written about the Chinese news media. "But they have to be careful. They may have flexibility, but it's flexibility with a leash."

One of my friends, who is close to Hu, told me that Hu and her Caijing are writing business stories to affect politics. And I couldn't agree more.

Sunday, April 17, 2005

Opinion_What are revised in the New History Book?

Most of the answers are "no" or "not yet". Why? Isn't newspaper or other media good at comparision between the original one(in fact, it is a draft) and rivised one? Why not this time?

Because most reporters couldn't read Japanese? or they assume the readers have already known the materials? or they are too lazy?

After some research on the topic, it is true that not much comparision or even provision of the words from the textbook is provided. Here is some excerpts from a Japanese website. Hope could make myself clear first before talking about it.

124 descriptions of the draft are revised this time, in line with instructions by the government's Textbook Authorization Research Council's. The number of revisions in 2001 was 137. (The revisions on the history textbook is conducted per four year)

five of those Revisions( I will try to find more):

(1) a side-note referring to the 1937 Nanjing Massacre that stated it as a fact, but only as an "incident."

(2) Draft: " the Tokyo Tribunal recognized the Imperial Japanese Army killed a great number of Chinese people."

Revised version:" . . . a great number of Chinese soldiers and civilians were killed and wounded by the Imperial Japanese Army."

(3) History textbooks no longer mention ianfu (comfort women) -- a controversial term that refers to women who were forced to provide sex for Japanese soldiers during World War II. Some texts use roundabout expressions, such as "those who were sent to comfort facilities."

(4) Draft: Japan has been involved in a dispute with China and Taiwan over the ownership of the Japan-controlled Senkaku islets in the East China Sea, known as Diaoyu in China, and with Seoul over Takeshima, a group of South Korea-controlled islets in the Sea of Japan known as Tok-do in South Korea.

Revised version: although the two disputed islands belong to Japan, China has insisted that it owns Senkaku and South Korea is "illegally occupying" Takeshima.

(5) Koreans who were "forced" ( 'kyousei renkou' ) to work in Japan during the war are changed to they were "brought to Japan."

Source:

http://www.japantimes.co.jp/cgi-bin/getarticle.pl5?nn20050406a1.htm(in English)

http://www.japantimes.co.jp/cgi-bin/geted.pl5?ed20050409a1.htm(in English)

http://www.japanresearch.org.tw/china/scholar-43.asp(in Chinese, a brief introuduction about the history textbook controversial since the end of the WWII)

Thursday, April 14, 2005

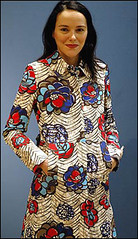

Fashion_the dresses are still good

Having said that, the Cacharel( shoot by Valerio Mezzanotti) dress on The New York Times is still good, while Hollywood movies are not bad, too.

Opinion_Japan and China, who is the victim?

If I explain it as the cultural difference in the arguments on the relation between Japan and China, it will look like silly because we are already in a era called globalization. But not many people try to understand the difference, either in the culture or government behavior, because the people are educated so differently. The newspaper and other media I see here is totally, or mostly, different from ones I read in the mainland, though they are both useful. I will not try to point out which is right or which is wrong, because there is not a universal standard.

I once heard one of my foreign friends said that "Patriotism is the worst thing for the Chinese". Yes, to the other countries, especially the not-that-friendly ones such as U.S., they will hate that because it means the people always support their countries, or the Chinese governments, in some extent. But to China, it may be a better thing because people will have nothing to believe if they lose patriotism. The dangerous thing is that China will collapse if people have nothing to believe, and how about the money of those foreign investors' money?

I would like to say I keep a open mind to what people say about Chinese and Japanese. And I will keep the good habit, too. But should I keep silent all the time, or say it though others may not respect or even read?

Bank_Financial Planner, everyone's need?

That's you will hear if you have a personal financial planner. He will help you get a steady return on your savings with investing into different financial products. He will also prepare you for the number of money planning for the certain periods. A professional word for the service is "Wealth management".

The best companies in wealth management is from Swizterland, such as UBS, according to one of my business professors. Many small companies begin to fill the gap between individual customers and investment banks. B M Intelligence in Hong Kong, who is listed on the growth enterprise market, is one of the examples, who helps the individuals find the right financial products, from various investoment banks.

BM's advantage should be their small size with the turnover of about 9 million HK dollars in the last fiscal nine months, so that it could be quite flexible. But how it will compete with giant investment banks is a question because the sales department in those banks are always more aggressive. BM could focus more on the individual customers, which may not attract those sales people in the banks, though it is less profitable.

The money they offer is not that attractable, with only about 14,000 HK dollars for a financial planner and 8,000 for a planner trainee. With those money, how to maintain a decent life for themselves?

Wednesday, April 13, 2005

zhangziyi

Anchor A:

Have you heard of 26-year-old Zhang ziyi, who starred in the Crouching Dragon Hidden Tiger, been named as one of the most 100 influential people in 2005 by Time Magazine?

Anchor B:

Yes, unbelievable. Who is influnced by her?

That's the typical criticism to Zhang by the media in Hong Kong, also in China. But they have to admit, the young former dancer has been promoted to the internation limelight in the few years, without any famous family background.

She may not be admired by the people, but she shows to people, both like her or not, that a Chinese girl could do the things she wants with her efforts and hard work. That should be called "influnce", isn't it?

Telecom_NBA cooperate with China Mobile

basketball association, has cooperated with China Mobile, the biggest telecom company by users, on the content of its data service.

The M-zone service, a content package for mobile phones targeting to teen and young adult, will be promoted with the NBA game scores,statistics and downloads of NBA logos and player images.

As a typical cooperation contract, not specified period of the cooperation or the terms is referred in the press release. I could only find it is a "multi-year" agreement.

Anyway, not bad.

Saturday, April 09, 2005

Bank_Fund banks start in China

Two of the three banks, ICBC and Bank of Communications planed to set up joint venture with foreign firms, the China Securities Journal reported citied annoymous sources(in Chinese) on Thursday.

Bank of Communications plans to set up a fund operations with HSBC holding and Pacific Issurance company. ICBC plans to partner with Credit Suisse First Boston Corp. (CSF.YY) and China Ocean Shipping (Group) Co. to establish fund operations, the newspaper said. Bank of Construction has not confirmed the name of the cooperator though it confirmed there will be a foreign strategic investor, the newspaper added.

The regulators, including China' Central Bank, the China Banking Regulatory Commission, and the China Securities Regulator Commission, will grant the approval to the first fund management company by September.

But the lack of related law in China is a problem for the regulators to monitor the operation of those fund management companies set up by banks. The firewall between the daily deposit service and the securities investment has yet to set up. Chen Xiaoyun, the law official in the Central bank, said that the law to regulate the securities investment in the commecial banks are under construction, without giving the schedule, reported Sina.

U.S. met the same questions in 1930s, when the Bank of Act 1933 was introduced to limit commercial banks. Banks could receive no more than 10 per cent of their income from their income from the securities market, a limit so small that many abandoned their business on Wall Street, reported New York Times in 1998. Bank Holding Company Act of 1956 also places restrictions on what bank can do in the insurance businesses.

With the recent bribe scandal in the state-owned banks, investors should expect stronger regulations from the nation, besides internal auditing in banks themselves.

Bank_Japanese Nomura to expand in China

Nomura Holdings Inc.,

Also reported by Sina(in Chinese).

Tokyo-based Nomura, which isn't allowed to own more than a third of a securities firm under Chinese regulations, plans to set up a company in

The plan went after its

"Nomura needs to build its relationships with Chinese officials to overcome obstacles and win business," Yoji Takeda, who helps managing $250million as Head of Asia Equities at RBC Investment Management (Asia) Ltd. in Hong Kong, China daily reported in Jan. 2005.

In January, Nomura announced that it would expand its investment banking services in

Morgan Stanley has owned one third of China International Capital Corp., the biggest investment bank, since 1995. Goldman, received regulatory approval Dec. 2 to establish an investment-banking venture in

Nomura has recently named Yugo Ishida as its new Chief Executive of its International branch. in April 1.

Thursday, April 07, 2005

Company_Take care of your emails

SEC said that Morgan Stanley, the world's No.2 securities firm, has deliberately recycled the emails recordings in the backup tapes. The company's lawyers ``knew as of June 7, 2004, that nearly a third of the restored backup tapes did not contain e-mail, implying that they may have been recycled in violation'' of the SEC's 2002 order, Elizabeth Maass, the judge in the Perelman litigation said in the ruling. SEC wanted to find the evidence from those tapes if Morgan Stanley knew the accounting fraud at Sunbeam Corp., a Morgan Stanley client.

Almost a month ago, Harry Stonecipher, Boeing Chief Excutive, was fired by the board after one of his embarrassing emails with a senior woman executive was exposed to the board by an annoymous employee. Stonecipher has married with two adult children, according to the Guardian.

The emails inside Boeing are monitored by a program, which could make security personnel keep tabs on every employee's email messages, according to the report from International Labor Communications Association. The employees has to be careful in writing an email, or it will help ending the job. "What you say, wear, or maybe even think, and whom you choose to hang with, can mean the end of job or career. " The report said.

Not only employees, but also employers should be careful, too. So does Morgan Stanley. The regulators may force the company to provide the email recordings when they think it is possible. But at the same time, it is everyone's privacy that will be recorded in the tapes and exposed to the public.

At last, I began to wonder about the email providers such as Yahoo and Google. If , someone wants to check a suspected person's email content one day, will the companies do that?

Wednesday, April 06, 2005

Banking_Morgan Stanley kick off the credit card business

By giving the Discover unit to shareholders, Purcell would exit a business that generated 19 percent of last year's pretax profit, or $1.27 billion. Morgan Stanley, which decided to pursue a spinoff after former executives demanded Purcell's ouster, will be left with a smaller balance sheet and businesses more vulnerable to the ups and downs of stock and bond markets, Bloomberg reported after the interviews with some analysts.

Also, by giving the Discover unit to shareholders instead of selling outside will avoid the tax based on the Discover's total market value. Discover is the seventh-largest credit-card issuer, with more than 50 million cardholders. It is estimated that the Discover unit may be worth as much as $14 billion as a standalone company, said David Trone, an analyst at Fox-Pitt, Kelton.

Morgan Stanley doesn't give up credit-card business though it said it will spin off the Discover unit. It has opened a new website in United Kingdoms to advertise for its three credit cards named with Morgan Stanley.

"Each business - - securities and payments - - is exceptionally well positioned in its respective marketplaces, with world-class brands, strong momentum and significant growth opportunities." said Philip J. Purcell, Morgan Stanley's chairman and chief executive officer.

Does it mean Discover cards in U.S. is not world-class brand, but Morgan Stanley credit card in U.K. is?

Tuesday, April 05, 2005

Society_be good to animals

Those animals should hate humans forever though they are dead. Pity them.

It made me think of some Chinese's extreme actions towards Japan's possible election to U.N. counsel. It is already a new era when the relations between China and Japan has changed a lot from dozens years ago. Chinese should be view the development in a new way. But to those victims who suffered from the war, they may never forget the day when they were treated as those raccon dogs.

"Do not do things that you don't want others to do". An old Chinese saying said. Please remember, those crude people who treated animals badly, and those who never committed they have done that.

Monday, April 04, 2005

Media_Is a Fox business news channel possible?

Will fox succeed CNBC and Bloomberg to be the most popular business news channel? Hmmm, Rupert Murdoch has to work it out.

Blog_bloggers in Hong Kong

Someone said: The measurement of success in Hong Kong is money instead of others. Of course, blogging couldn't make a big money at this time.

I met an experienced reporter from China's newsweek today. We talked a bit about the media in China. His opinion on blog in China is quite interesting.

"I believe blog will act as only one of the news sources for the news aggregator. " He said.

That's totally not what I learned from my classes.

Friday, April 01, 2005

Economy_Japan, optimists outnumber pessimists

The confidence index for large manufactures fell to 14 points in March from 22 in December and a 13-year high of 26 in September, the Bank of Japan's quarterly Tankan business-sentiment survey showed yesterday.

The drop adds to signs that a recovery from recession has stalled, after reports this week showed falling factory production and household spending. Higher prices of oil, plastics and metals are curbing profits at companies including Matsushita Electric Industrial Co., leaving them less money to hire workers and buy machines, reported Bloomberg.

"Japan is struggling in the balance sheet recession period, and the government has depended on fiscal policy to maintain demand". Richard Koo, the Chief Economist at Nomura Research Institute in a seminar yesterday.

Koo said that Japanese companies are injecting the cash flow from China's business to pay down the debt on their balance sheets, which helps reducing the domestic demand in Japan. "The government had to lend a lot from the banks to make the economy boosted." He added.

The confidence index among mid-sized and small manafactures each fell 5 points to 6 and 0 from last December, while the confidence among large non-manufactures was unchanged at 11 points.

Japan's NIKKEI average rose 122.83, or 1.09 per cent, to 11692.37 at 14:02 pm in Tokyo. Does it mean optimists still outnumber pessimists on Japan's Economy?