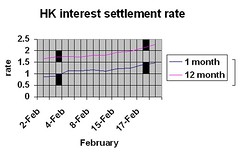

The Hong Kong average interest settlement rates has grown up above 50 per cent two weeks after the first surge of the US interest rate this year. The regulator has obliged the banks to raise the interest rate as soon as possible to avoid more outflow of the capital in the market.

But banks are still cautious at raising up the interest rate, though the rising settlement rate makes them earn less from the borrowers under the current agreement

Under the Forward Rate Agreement, or FRA, Hong Kong banks and the borrowers has locked in an interest rate for a stated period of time starting on a future settlement date. The borrowers could use FRA to protect itself from a future increase in interest rates. The banks could protect itself from a future decline in interest rates. When the settlement rates, which is updated by the Hong Kong Association of Banks every day, is higher and the interest rates remains unchanged, banks have to pay the interest differential to borrowers. Further details and calculating methods could be reached here.

Hong Kong Monetary Authority, has urged banks to raise the interest rate to peg the growth of the US interest rates, in order to prevent the sudden and large amount of capital outflow when bank raise the rates. Joseph Yam Chi -kwong, Chief Executive of HKMA, hinted of future interest rates rise on Feb 4 and more directly urged banks to rise their interest rates on Feb 17. The settlement rate stopped rising for several days after his first speech(see the grid marked black in the picture), but continued rising shortly.

The authority wants the market acting in a gradual and soft way, while banks are going after the profit as most as they could. It is like a pull-and-push game, where borrowers need to pay close attention to win.

Subscribe to:

Post Comments (Atom)

3 comments:

Yes, I believe, in some extent, HKMA couldn't force the banks to grow up interest rates, though it is willing to. You give a good reason why the banks haven't done it yet. I guess they also would like to increase it after they announce their annual reports. Big banks want to have a good share price when the reports are given. Small banks may wait for big banks' action. Something may happen after HSBC and Hangseng's reports on Feb 28. Hehe, I guess

I totally agree what you said PRC's cheap labor and low price product have pulled down HK's inflation these days. See many HK people buying properties, daily stuffs and enjoying cheap living expense in Guang Dong province. Inflation is struggling with so-called "deflation" now:)

Yes, I think so. That's why central government are making policies on pushing the loans to SMEs. In fact, most of them are suffering from the tighter financial policy.

Post a Comment